Counterpoint Research, Displays

[email protected]

FOR IMMEDIATE RELEASE: 05/05/2025

XR Display Market to Grow 6% YoY as AR Smart Glasses Gain Momentum

Seoul, Beijing, Buenos Aires, Hong Kong, London, New Delhi, San Diego, Taipei, Tokyo -

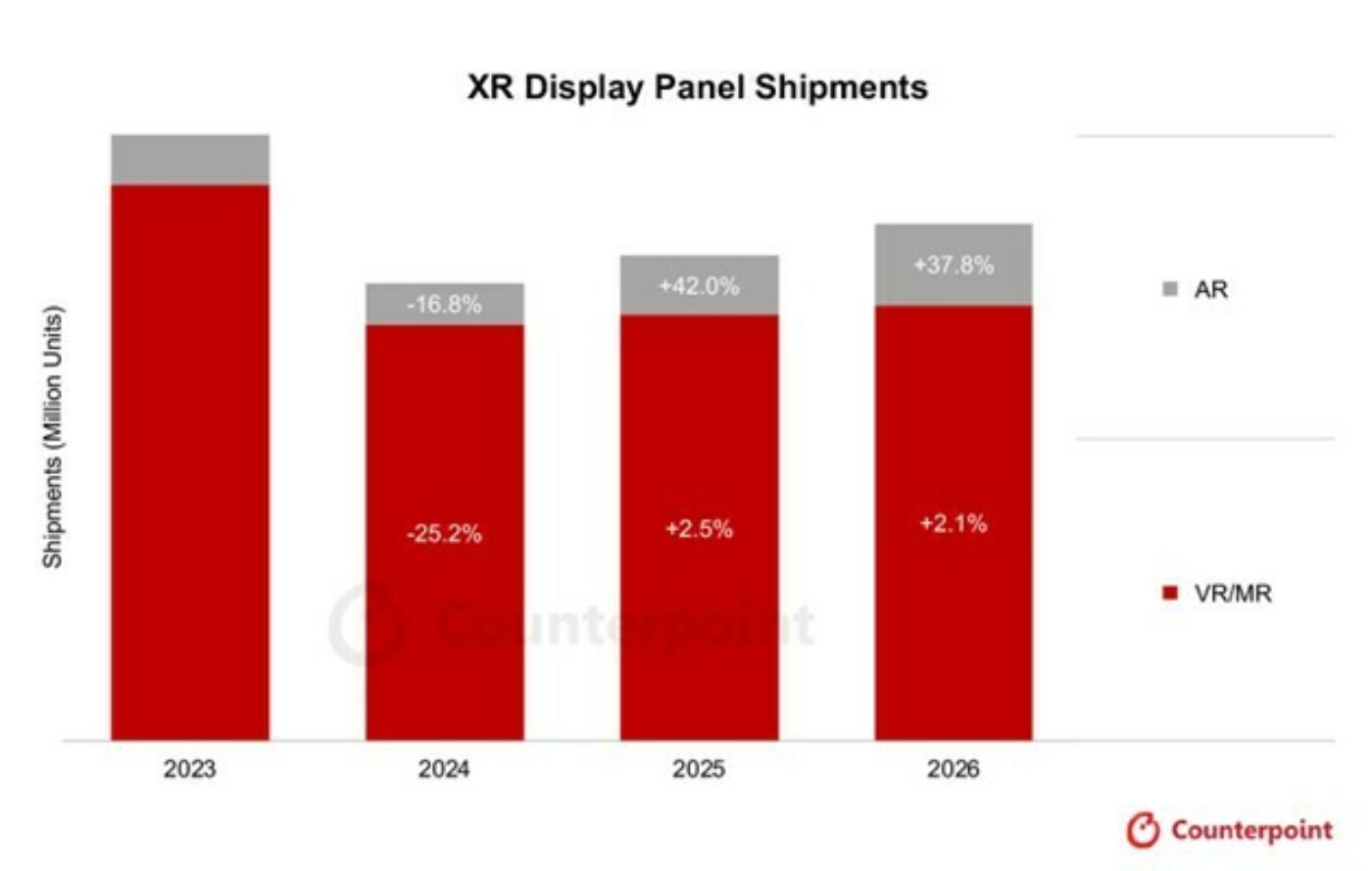

- Global XR display shipments are expected to rise 6% in 2025, with shipments for AR glasses growing 42%.

- The growth will be a partial recovery, following a significant drop in display shipments in 2024.

- LCD will represent an 87% share of VR panel shipments, while OLED-on-Silicon will have a 75% share in AR.

- The recovery is projected to continue next year, but US tariffs on China bring a high level of uncertainty.

Global XR (AR/VR) display shipments are expected to increase 6% YoY in 2025, according to the latest XR Display Shipments and Forecast Report by Counterpoint Research. While AR remains a relatively niche segment, it will grow the fastest at 42% YoY, compared to only 2.5% YoY for VR. This will be driven by the launch of new AR smart glasses that use the display for AI-enabled applications instead of media consumption.

Last year saw a significant drop in panel shipments as XR device makers tried to clear inventories and revised their business plans. The launch of the Meta Quest 3S was another contributing factor for the lower panel shipments since this headset includes a single LCD panel instead of two panels. In this context, the projected growth in 2025 will only be a partial recovery and panel shipments will remain far below the level seen back in 2023.

LCD is expected to stay the dominant technology in VR, with an 87% share of shipments in 2025. LCD is not only used in entry-level headsets but also in high-end devices with advanced features such as quantum dots and MiniLED. For AR, the share of OLED-on-Silicon is expected to decrease to 75%, making room for a larger share of MicroLED and LCoS displays. While Meta and Google have recently demonstrated fully functioning MicroLED smart glasses, they have not announced plans to commercialize them yet. However, several Chinese brands, as well as Even Realities in Europe, are already selling lightweight AR glasses with MicroLED and waveguide technologies.

The recovery is currently projected to follow a similar pattern in 2026, with display shipments increasing 38% for AR and 2.1% for VR. However, there is a lot of uncertainty over US tariffs imposed on Chinese products and how they will impact demand for XR devices. Without a rapid de-escalation in the trade war, the forecast will likely be downgraded in the next quarterly update.

Associate Director Guillaume Chansin will present an overview of the XR display market at the upcoming SID Business Conference at the San Jose Convention Center. Featuring over 20 speakers, including 5 Counterpoint analysts, the conference will take place during SID Display Week on May 13 and 14. To see the agenda and register, visit https://display.counterpointresearch.com/events/2025-sid-business-conference-powered-by-counterpoint-research.

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.