Counterpoint Research, Displays

[email protected]

FOR IMMEDIATE RELEASE: 06/02/2025

TVs, Tablets Help Flat Panel Display Market Recover in 2024; Automotive to Drive Future Growth

London, Beijing, Buenos Aires, Fort Collins, Hong Kong, New Delhi, Seoul, Taipei, Tokyo -

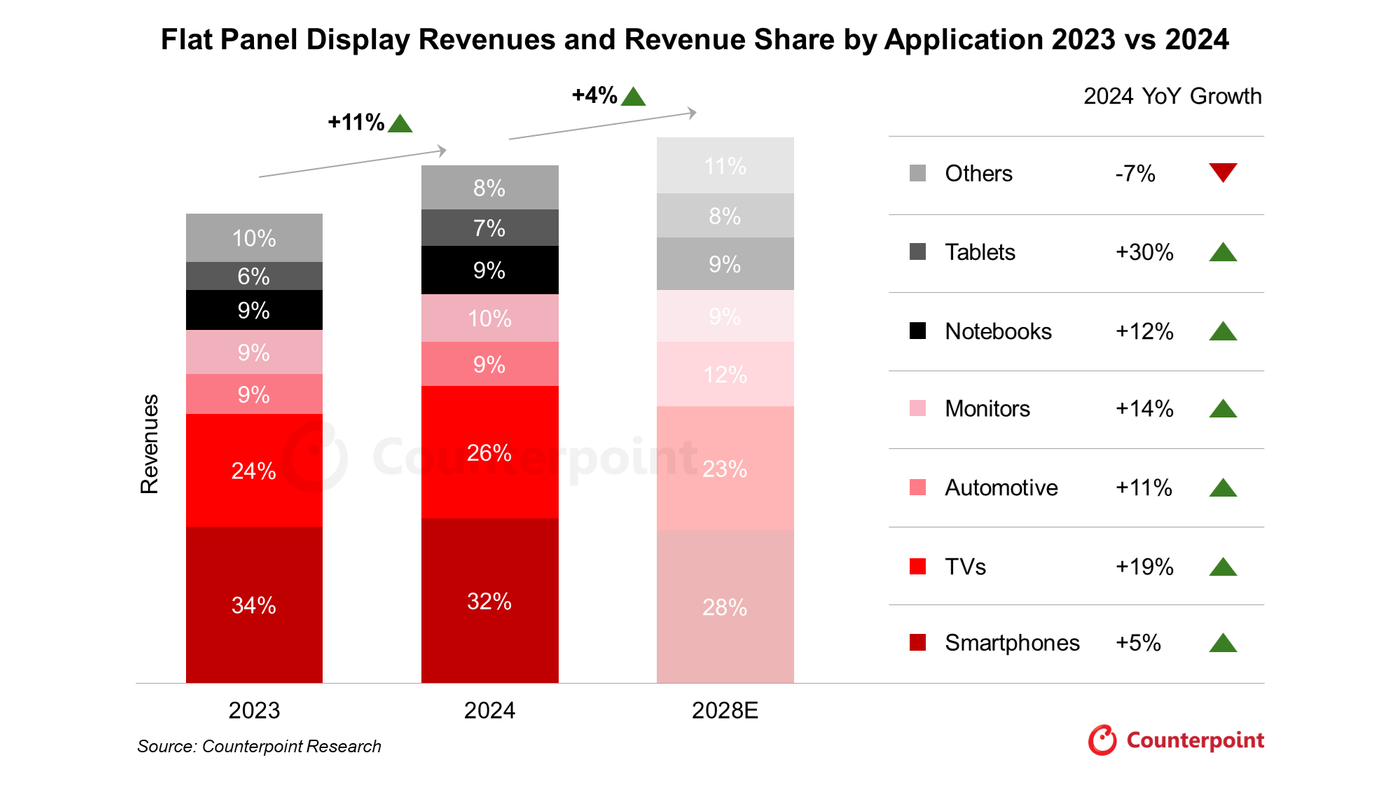

- The global flat panel display market’s revenues grew 11% YoY in 2024 after bottoming in 2023.

- Strong revenues across a broad range of applications including tablets, TVs, monitors, notebooks and automotive reflect improved dynamics across a variety of metrics.

- We expect overall 2025 revenue growth to remain comparatively flat, weighed down by shrinking smartphone unit sales.

- We remain bullish on automotive displays with both short-term and long-term revenue growth expected to be in the high single digits to low double digits.

The global flat panel display market’s revenues saw an 11% YoY increase in 2024 driven by a broad range of product categories, according to Counterpoint Research’s latest Flat Panel Display (FPD) Tracker and Forecast Report. TVs and tablets helped contribute most to this growth. Moving forward, the automotive segment will become a significant driver.

Smartphones remained the biggest segment for flat panel displays in 2024 but growth was comparatively flat, mirroring shipment growth downstream. We expect smartphone panel revenues to decline in the long term.

TV panel revenues increased 19% YoY in 2024 driven by higher demand in the large-screen segment, which helped improve overall ASPs. “Growth last year was steep but it is unlikely to continue in the long term,” said Research Director Bob O’Brien, adding, “The bump last year was a reset. Moving forward, we see TV panel units, and especially screen size areas, ticking up. But intensifying price competition is likely to send overall panel revenues downwards after 2025.”

“On the tablet side, the introduction of OLED panels on the large-screen iPad Pro models helped push tablet panel revenues to pandemic-era levels. “Tablet growth is now product driven, and the next cycle will be in 2028 when we expect to see Apple foldables hit the market,” said O’Brien.Monitor and PC flat panel revenues also grew in double digits in 2024 after bottoming in 2023 at the end of the post-pandemic slump. Moving forward, we expect the growth here to hover in the mid-single digits.

AR/VR panel revenues fell, mirroring what happened with device shipments. “2024 was another tough year for the AR/VR device markets, with both segments experiencing shipment declines,” observed Associate Director Guillaume Chansin, adding, “But we are expecting to see growth over the next year or two, especially as AI becomes more tightly integrated into these platforms – and this growth is obviously being reflected in our AR/VR panel forecasts too.”

Auto cockpit infotainment trends are driving automotive panel revenues as demand for both larger and more sophisticated displays increases unit demand and ASPs. In the long term, we see this segment growing fastest across all flat panel display categories.

“Automotive is the hot segment moving forward and it is growing across every dimension,” noted Associate Director Greg Basich, adding, “More, bigger and better is how things are evolving with cockpit infotainment systems, a real battleground for automakers, especially Chinese OEMs .”

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.