Counterpoint Research, Displays

[email protected]

FOR IMMEDIATE RELEASE: 06/23/2025

TCL, Hisense Threaten Samsung’s Leadership in Premium TV Market

Seoul, Beijing, Buenos Aires, Fort Collins, Hong Kong, London, New Delhi, Taipei, Tokyo -

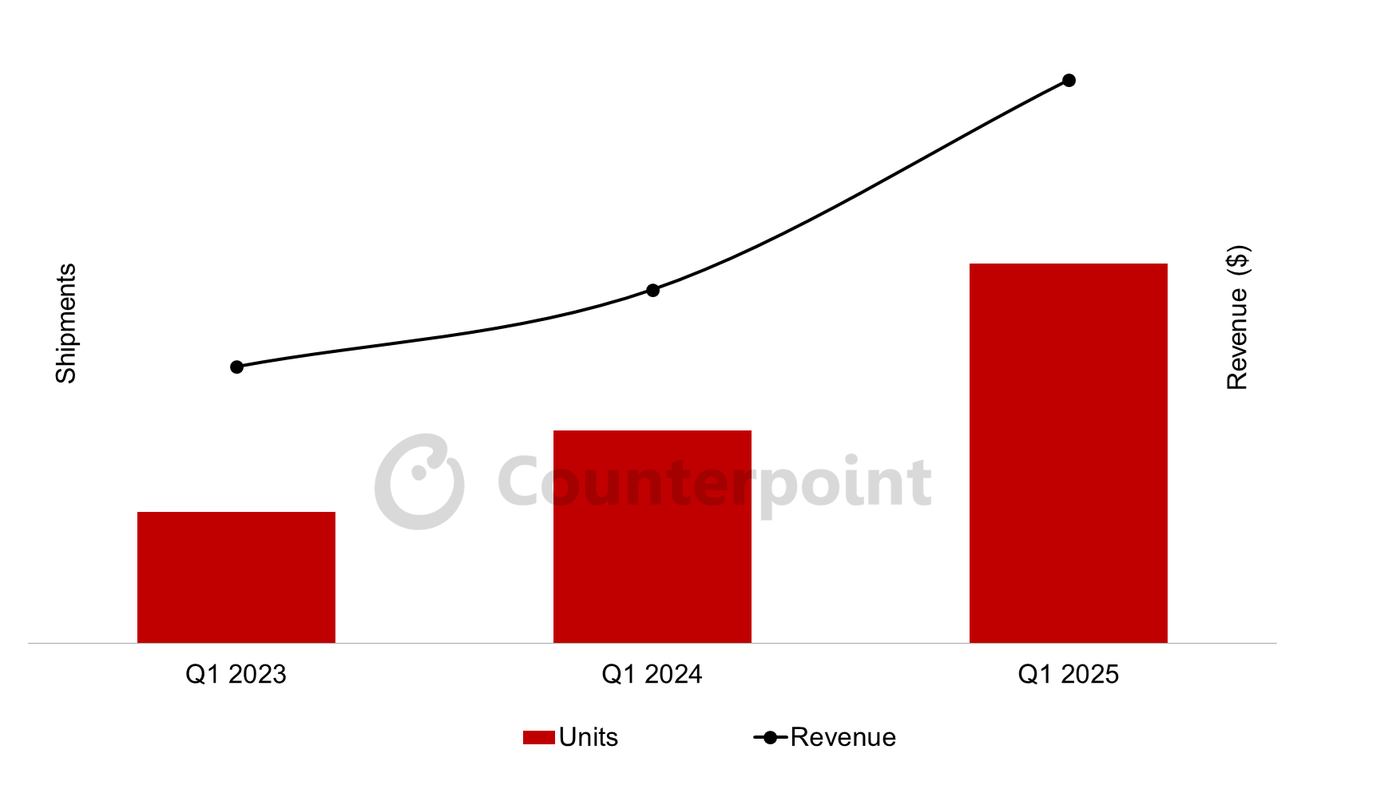

- In Q1 2025, global Advanced TV shipments increased 44% YoY and revenues increased 35% YoY.

- TCL and Hisense increased their shipments by triple-digit percentages YoY. Both companies are gaining share driven by their emphasis on MiniLED TVs and ultra-large (>75”) screens.

- Samsung still leads the Advanced TV category, but its share has decreased as the Chinese brands gain.

Global Advanced TV shipments increased 44% YoY and revenues increased 35% YoY in Q1 2025, according to Counterpoint Research’s latest Quarterly Advanced TV Shipment and Forecast Report. TCL and Hisense were the market’s key drivers, more than doubling shipments compared to the same period last year and coming closer to rivaling Samsung, the market’s leading brand for the last 20 years. Hisense and TCL accounted for a huge portion of shipment growth, reflecting the rise of Chinese brands over the past year.

In terms of regional markets, China was the main driver. “Helped by government incentives that encouraged consumers to trade in older TVs for new models, and aggressive promotions from domestic brands, Advanced TV revenues in China surged at triple-digit percentages,” said Research Director Bob O’Brien, adding, “Chinese consumers purchased bigger, more expensive TV sets with more advanced display technologies.”

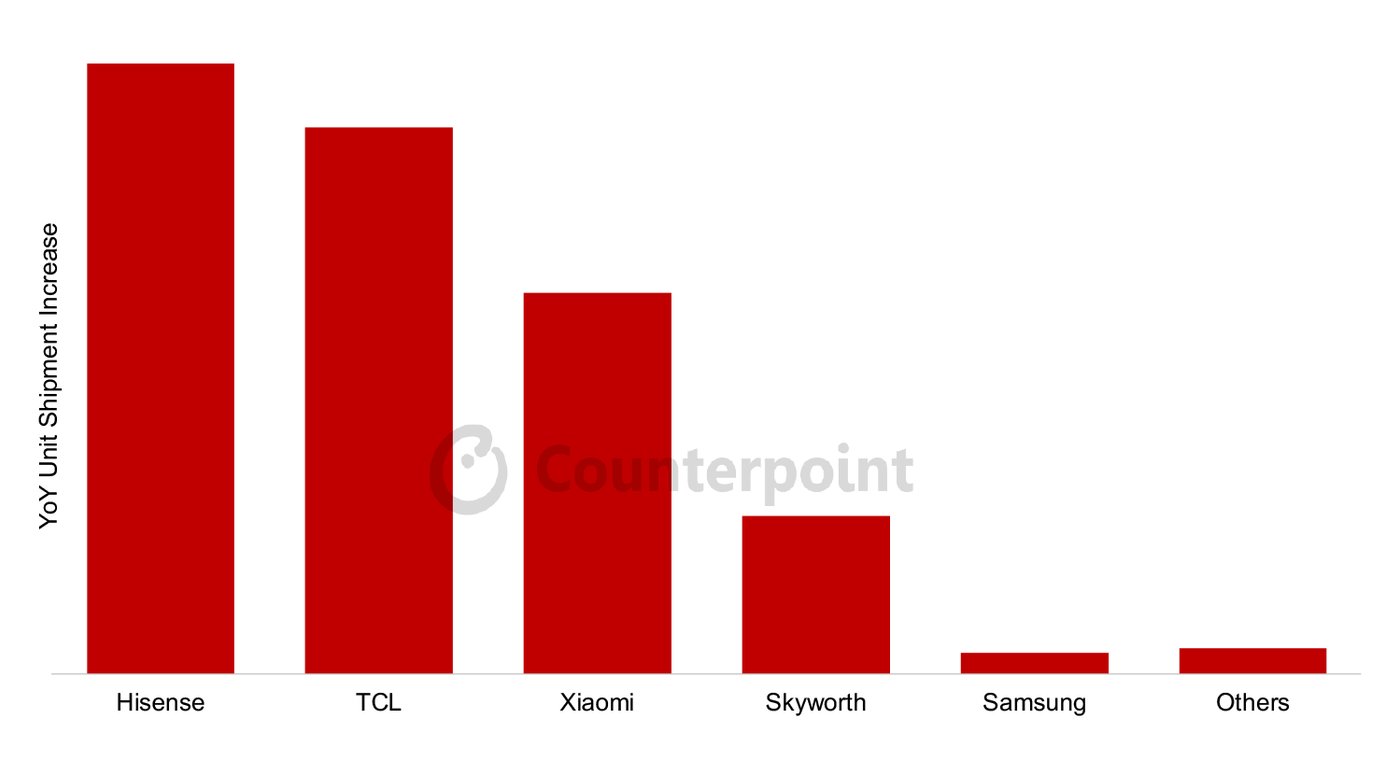

The revenue growth in the China market, plus share gains in other key regional markets, drove global share growth for both Hisense and TCL. Both companies saw triple-digit % YoY increases in shipments. Revenues for Hisense and TCL increased YoY by 87% and 74% respectively. Hisense’s unit share of the premium TV market increased from 14% in Q1 2024 to 20% in Q1 2025, and its revenue share from 13% to 17%. TCL’s unit share jumped from 13% to 19% and its revenue share increased from 13% to 16%. Beyond the top two in China, Xiaomi and Skyworth also registered big gains.

Top 5 OEMs in Terms of YoY Unit Shipment Increase, Q1 2025

Those gains came largely at the expense of the two South Korean giants. While LG and Samsung focused their efforts on OLED TV, the Chinese brands were making OLED less important to the overall premium market by aggressively promoting large-screen MiniLED LCD models. MiniLED is taking an increasingly larger share of the “super-premium” market. MiniLED TV shipments and revenues surpassed OLED in Q2 2024 and it has increased its share of the super-premium market in each quarter since then.

“MiniLED TVs typically compete at price points similar to OLED TVs, but because of the cost difference between OLED and LCD TV panels, consumers face a choice between a smaller OLED TV or a larger MiniLED TV,” said O’Brien, adding, “An increasing number of consumers are choosing MiniLEDs.”

TCL was the first brand to introduce MiniLED in 2019, but Samsung’s introduction of MiniLED in 2021 allowed it to quickly dominate the category. Samsung still led the category in 2023 but was passed in 2024, first by TCL, then by Hisense and then by Xiaomi. In Q1 2025, Samsung held the #4 position in units and #3 position in revenues, looking up at its Chinese competitors.

For the first time in decades, Samsung faces a legitimate threat of losing leadership of the TV market. The Chinese TV brands, especially TCL and Hisense but also Xiaomi and Skyworth, have chosen not to try to compete with Samsung’s strength in OLED TV, but instead have chosen to leverage China’s dominance in LCD to achieve a lower-cost position, and then leverage that lower cost to aggressively promote very large MiniLED LCD screens which the South Korean brands cannot match. Consumers are increasingly showing that the Chinese brands have made the right choice.

The largest-size TVs drove the growth in both units and revenues in Q1. Shipments of 75” and larger Advanced TVs increased 79% YoY while revenues increased 59%.

Shipment and Revenue Growth of 75”+ Advanced TVs

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.