Counterpoint Research, Displays

[email protected]

FOR IMMEDIATE RELEASE: 08/11/2025

Signs of Change in Global OLED Evaporation Material Market as Chinese Companies Forge Ahead

Seoul, Beijing, Berlin, Buenos Aires, Fort Collins, Hong Kong, London, New Delhi, Taipei, Tokyo -

- The global OLED evaporation material market’s revenue is expected to grow around 5.3% YoY in 2025.

- Chinese OLED evaporation material companies’ revenues are expected to grow 21% YoY in 2025. Their share of materials revenue from Chinese panel makers is forecast to reach 43% in 2029.

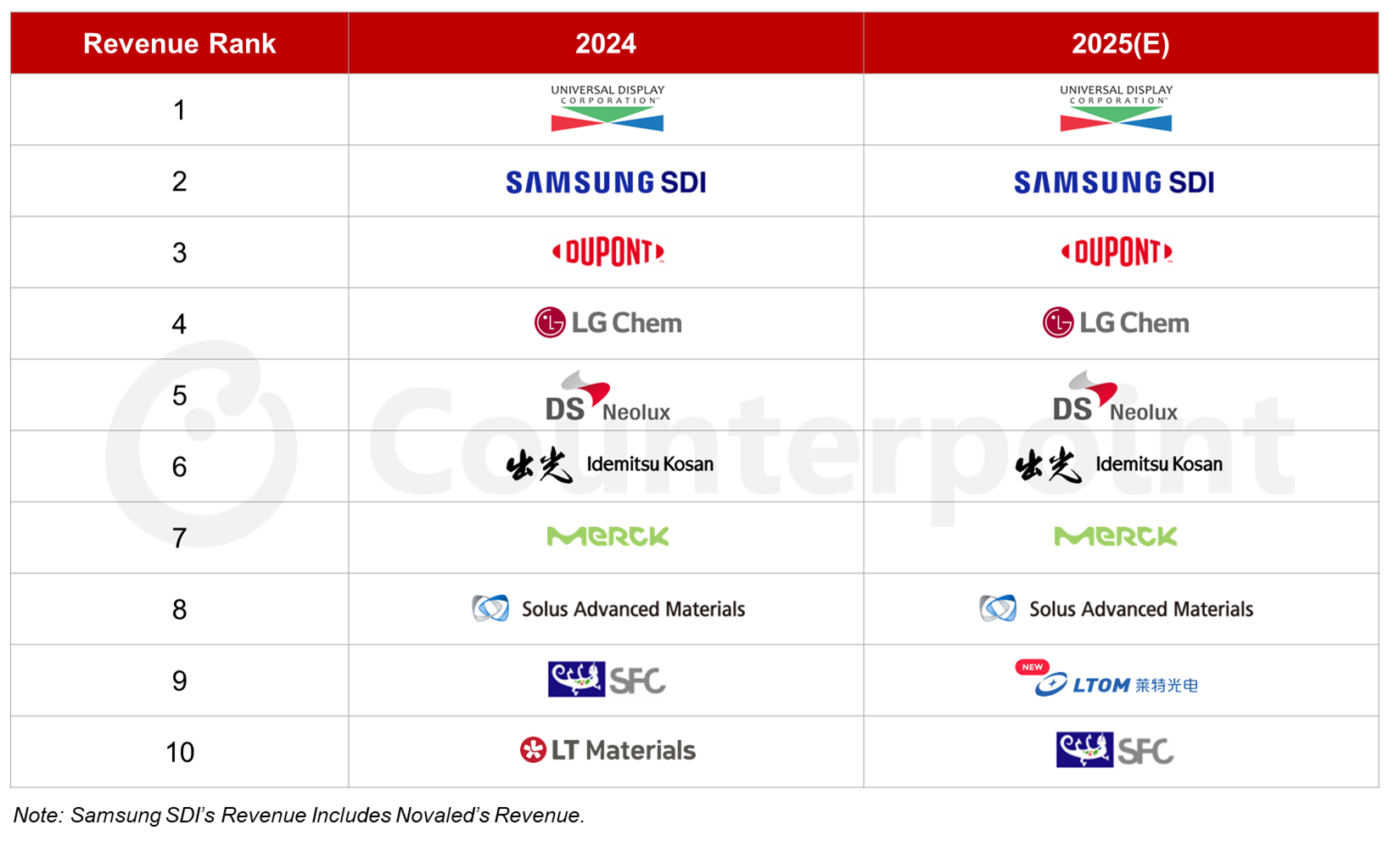

- In 2025, LTOM is expected to become the first Chinese OLED evaporation material company to enter the top 10.

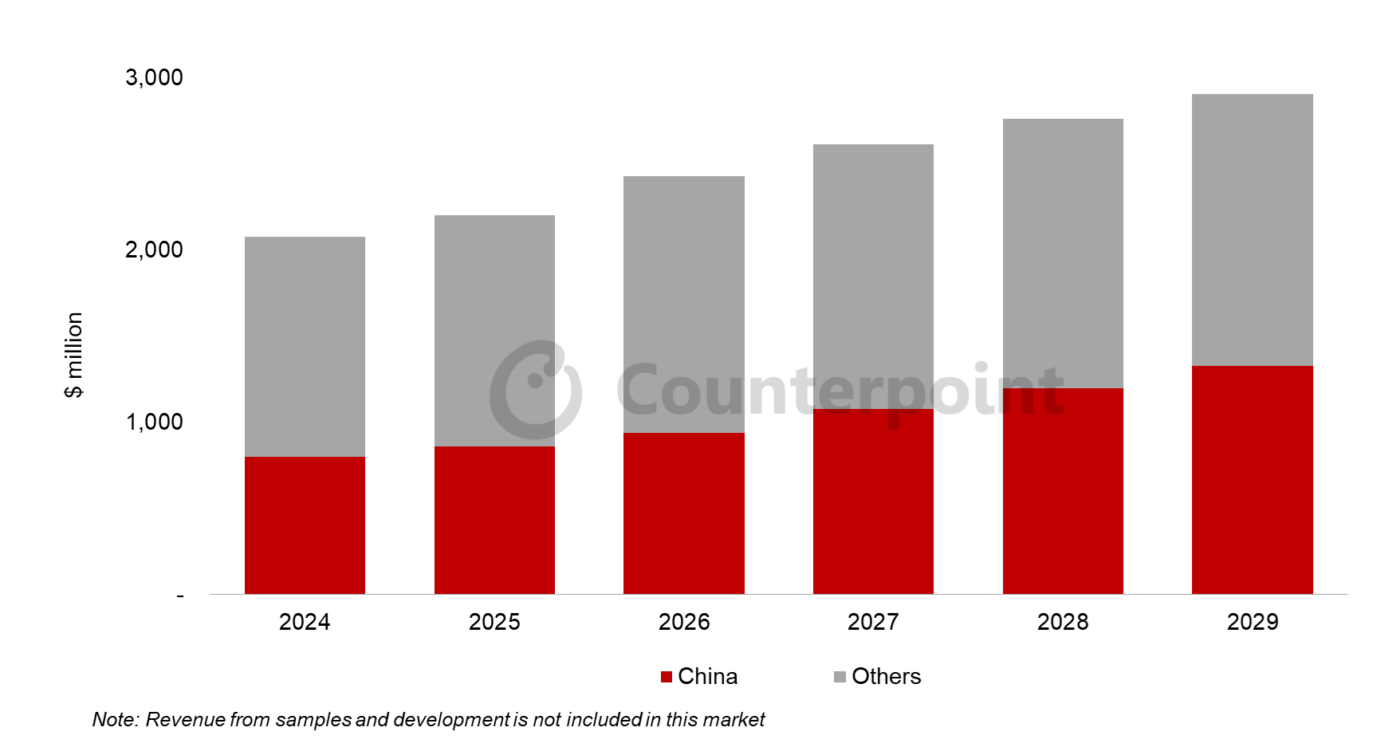

The international OLED evaporation material market’s revenue is expected to grow around 5.3% YoY in 2025, according to Counterpoint Research’s latest Semi-Annual AMOLED Materials Report. It is projected to reach around $2.8 billion by 2029 at a compound annual growth rate (CAGR) of 7%.

There are three main factors behind this market growth: (1) Chinese panel makers continue to operate at high utilization rates, along with the continued expansion of sixth-generation OLED production capacity. (2) Eighth-generation IT OLED lines will soon start mass production against the backdrop of rising OLED adoption in the notebook and tablet markets. (3) With high-performance OLED material structures, such as two-stack tandem IT OLED, four-stack WOLED and five-stack QD-OLED, being applied to products, the use of RGB-emitting materials is expected to rise.

In particular, most eighth-generation IT OLED production lines are designed with two-stack tandem structures in mind. If customer acquisition is successful, the usage of OLED deposition materials is expected to expand, further increasing the OLED evaporation material market’s growth rate.

AMOLED Evaporation Material Market Revenue (2024 – 2029)

Among these developments, the most notable is the growth of Chinese OLED evaporation material companies. The abovementioned report includes an analysis of the 2024 performance of nine promising Chinese OLED evaporation material companies and their projected sales trends through 2029.

According to the report, China's OLED evaporation material demand is expected to account for 46% of the global demand by 2029.

As of 2024, Chinese OLED evaporation material companies’ share of materials revenue from Chinese panel makers was about 33%. It is expected to expand to 43% by 2029. In particular, Chinese OLED evaporation material companies are gradually securing technological capabilities in the high-price OLED evaporation material segment, which had been difficult to enter in the past. Among them, LTOM is expected to become the first Chinese OLED evaporation material company to enter the global top 10 in 2025.

Top 10 AMOLED Evaporation Material Suppliers by Revenue

Unlike existing Chinese OLED evaporation material companies that mainly deal with common layer materials, LTOM supplies high-value-added emission and functional materials such as Green Host and R-prime HTL to BOE. Recently, it has expanded its supplies to other panel makers in China, and is also actively developing G-prime HTL, Red Host, and new materials for next-generation OLEDs.

Another noteworthy company is Summer Sprout. This company has succeeded in supplying high-difficulty, high-cost materials such as p-dopant, red dopant and green dopant to major Chinese panel makers. These materials had been monopolized by a few global companies such as UDC and Novaled due to high technological barriers. If Summer Sprout expands its supply volume and secures additional customers, it is expected to show rapid growth and achieve the second-highest sales after LTOM by 2027.

Senior Analyst Kyle Jang said, “Until now, OLED evaporation materials from Chinese companies have mostly been used in products for the domestic market. But since 2024, some have begun to be adopted in global models, and global market share expansion will begin in earnest.”

Jang added, “If Chinese OLED evaporation material companies improve their technology through patent licensing pacts or collaboration with global material companies, the market landscape could change significantly in the future.”

Counterpoint’s Semi-Annual AMOLED Materials Report covers not only major OLED evaporation material structures currently applied in mass production by OLED panel makers and material suppliers by layer, but also trends in next-generation OLED material technology, including Phosphorescent Blue, TADF and Hyperfluorescence. The report also addresses other important issues and technologies related to OLED materials, like tandem structures, inkjet printing, organic photodetectors (OPD) and Color on Encapsulation (CoE).

In addition, the accompanying Excel report provides a detailed analysis of market performance and material usage by panel maker, major companies (including nine Chinese OLED evaporation material makers), material type and technology type, along with forecasts through 2029.

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.