DSCC

[email protected]

FOR IMMEDIATE RELEASE: 04/08/2024

Robust OLED Growth in 2H’23 Signals a Strong 2024 Recovery Fueled by Smartphones, TVs and IT Applications

La Jolla, CA -

- 2H’23 OLED revenues saw a 50% improvement vs. 1H’23.

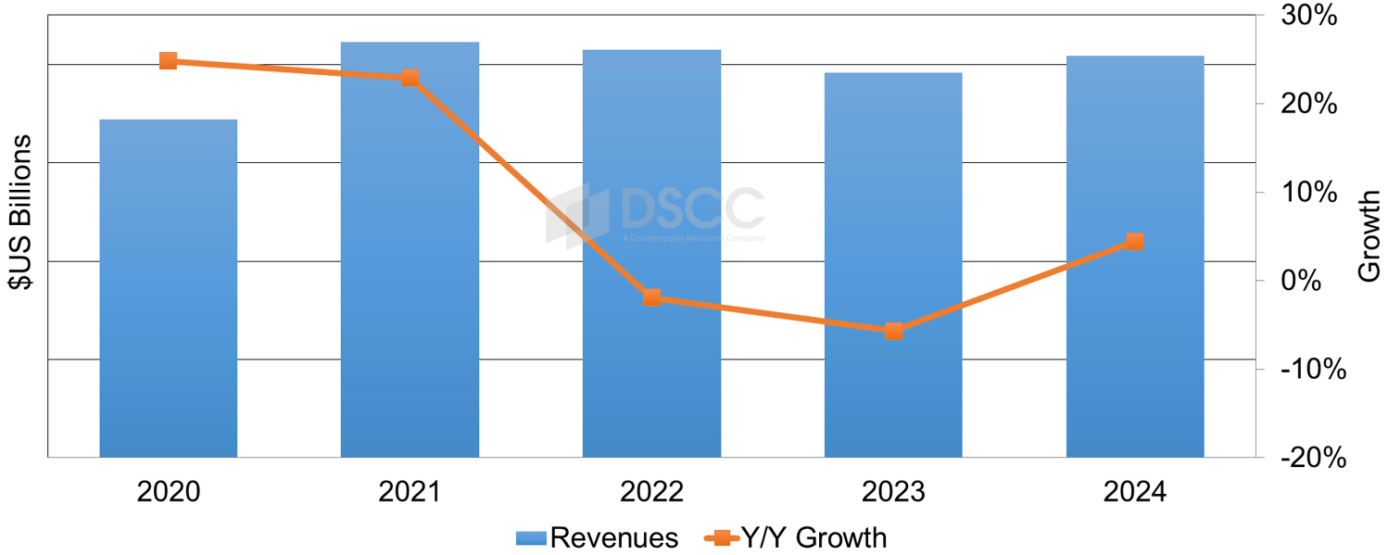

- In 2024, OLED revenues are expected to increase 11% Y/Y in units and 4% Y/Y in revenues.

- In 2024, OLED smartphones, TVs and IT applications fuel double-digit growth.

As revealed in DSCC’s latest release of the OLED Shipment Report, OLED panel revenues declined 4% Y/Y in 2023 versus our prior estimate of a 9% Y/Y decline. The improvement to panel revenues is the 9% Y/Y increase for units as a result of the 2H’23 inventory and demand improvement for several applications.

The second half of 2023 saw a recovery in many segments as excess inventories continued to improve and a strong back-to-school and holiday selling period. China’s GDP grew 5.2% in 2023, despite a pessimistic estimate of 4.6%. In the US, GDP grew 3.3% in 2023, offering a good indicator that the US Federal Reserve had managed to bring down inflation and secure a “soft landing” without major repercussions for workers or the economy.

“As a result of macroeconomic and inventory corrections, combined with double-digit ASP declines, we expect 2024 to recover from the post-pandemic downturn,” notes David Naranjo, Senior Director. In 2024, unit and revenue growth for flagship smartphones and OLED TVs is expected on lower panel ASPs, For IT applications, OLED tablets are expected to have triple digit Y/Y growth as a result of Apple entering the OLED tablet category in addition to double-digit Y/Y growth for monitors and notebook PCs.

AMOLED Panel Revenue and Y/Y Growth, 2020 – 2024

The latest OLED Shipment Report includes updates to market forecasts as well as updates for panel supplier and brand roadmaps.

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.