Counterpoint Research, Displays

[email protected]

FOR IMMEDIATE RELEASE: 04/10/2025

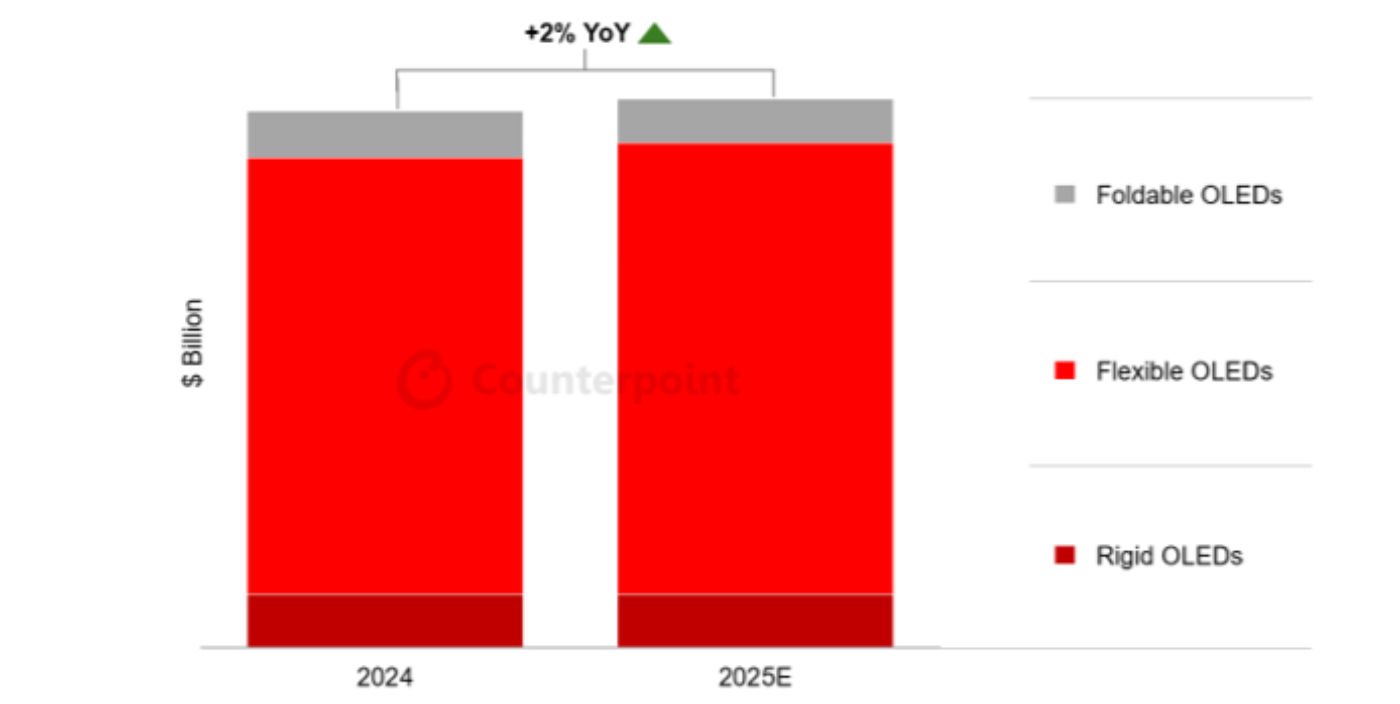

OLED Smartphone Panel Revenues to Increase 2% YoY in 2025 on 6% YoY Unit Growth

Seoul, Beijing, Buenos Aires, Hong Kong, London, New Delhi, San Diego, Taipei, Tokyo -

- In 2025, we expect to see only 2% YoY growth for OLED smartphone panel revenues on a 6% bump in OLED smartphone units.

- Panel gains will be made on flexible OLEDs with the premium smartphone segment remaining strong.

- The biggest revenue declines are happening in mid-range devices as well as foldables.

- This follows a string of high-growth years, with 2024 revenues growing 10% YoY on 33% YoY unit growth driven by strong demand from Chinese OEMs, Apple and Samsung.

OLED smartphone panel revenue growth is likely to be relatively flat at 2% in 2025, while OLED smartphone unit shipments are projected to increase by 6%, according to Counterpoint Research’s Advanced Smartphone Display Shipment and Technology Report.

A pullback in rigid OLED and foldable OLED smartphones will temper revenue growth for the OLED segment. Rigid OLED smartphones are expected to decline by 2% YoY after recording 53% YoY growth in 2024. Foldable OLEDs are expected to experience a 7% YoY decline after a 7% YoY increase in 2024 as brands continue to prioritize other business areas over foldables. Samsung is expected to be an exception, as it is likely to bring the Z Flip FE to market at a lower price.

Annual OLED Smartphone Panel Revenues by Substrate, 2024-2025

In 2024, in terms of OLED smartphone panel procurement by brand, Apple led with a 28% unit share, down from 36% in 2023 due to gains by OPPO, Samsung, vivo, Xiaomi and others. Huawei declined to a 5% share, down from 6% in 2023 because of declines for the Mate 60 series and P60 series. Samsung rose to a 22% share, up from 19% in 2023 due to a 54% YoY increase in units driven by an 85% YoY increase for rigid OLED smartphones and a 29% YoY increase for flexible OLED smartphones.

Associate Director David Naranjo said, “In 2025, we expect OLED smartphones to increase by 6% YoY in unit terms and 2% YoY in panel revenue terms as Apple, Huawei, OPPO, Samsung, vivo, Xiaomi and others increase their volumes. We expect flexible OLED smartphone panel revenues to increase by 4% YoY. Foldable OLED smartphone panel revenues are expected to decrease by 6% YoY, while rigid OLED smartphone panel revenues are expected to decrease by 1% YoY. Indicators point to a strong buildup and momentum fueled by AI and new models from Samsung, Apple and others.”

For 2026, we expect flexible OLED smartphones to continue to grow YoY as blended panel ASPs continue to decline. For foldable OLEDs, we expect Apple’s entry to make 2026 a record year for foldable panels, with shipments growing 54% YoY. Counterpoint Research’s latest Foldable & Rollable Display Shipment & Technology Report supports this growth view for 2026 by projecting mid-double-digit YoY growth in panel procurement. “The supply chain is telling us its foldable order books are filling up further out,” said Research Director Calvin Lee, adding, “At the moment, this does not look like a market that is plateauing – it looks like a market that is about to transform. And that requires a lot of planning, hence the slight pullback this year.”

*This report was released before the Trump tariff announcements. Readers interested in our latest views, can contact [email protected]

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.