DSCC

[email protected]

FOR IMMEDIATE RELEASE: 08/19/2024

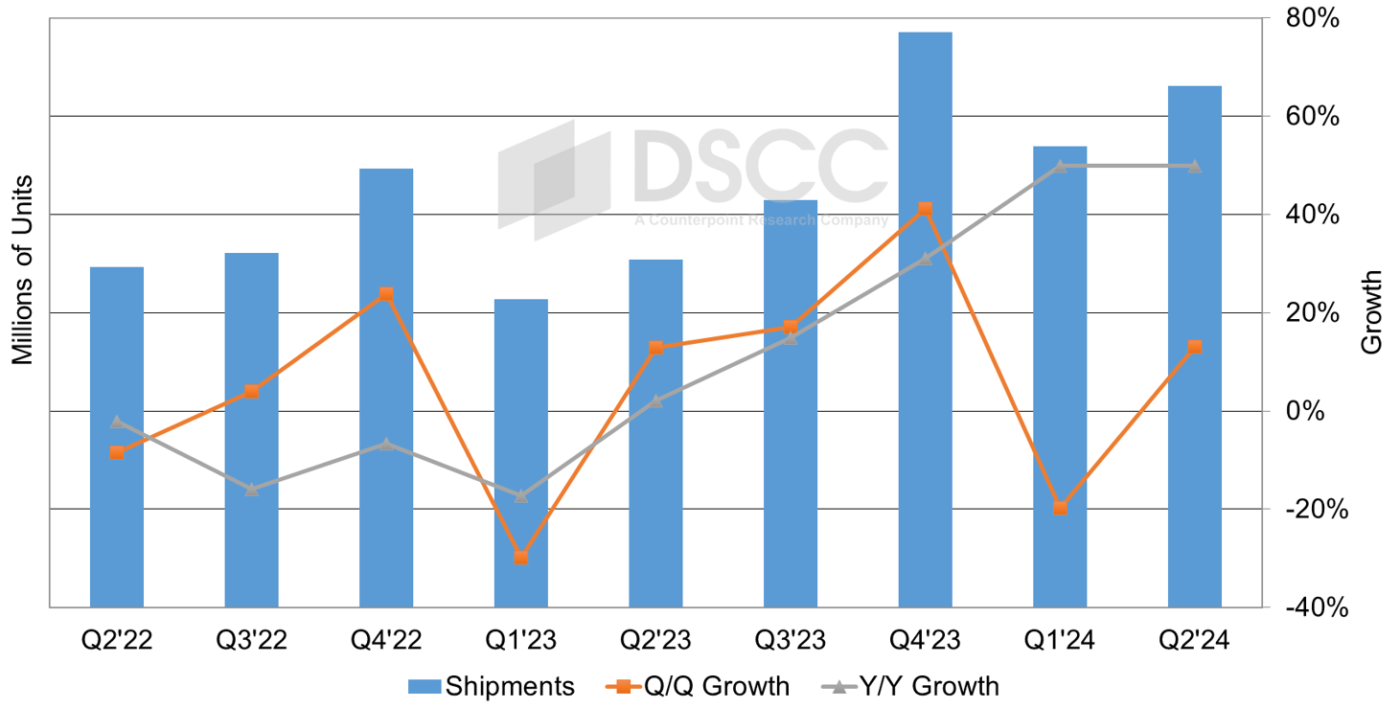

OLED Panel Shipments Rise 50% Y/Y in Q2’24 on >100% Growth in Tablets and Monitors and High Double-Digit Growth in Smartphones and TVs

La Jolla, CA -

- In Q2’24, OLED panel shipments increased 50% Y/Y, led by growth from smartphones, TVs, monitors and tablets.

- OLED smartphone panel shipments rose 49% Y/Y.

- Samsung Display continues to lead with double-digit share for all OLED applications with its unit share rising for the first time in seven quarters.

As revealed in DSCC’s latest release of the OLED Shipment Report – Flash Edition, OLED panel shipments increased 13% Q/Q and 50% Y/Y in Q2’24 after declining 20% Q/Q and increasing 50% Y/Y in Q1’24. In Q2’24, by select OLED applications, OLED tablet panel shipments increased 142% Q/Q and 356% Y/Y, OLED smartphones increased 6% Q/Q and 49% Y/Y and OLED TVs increased 43% Q/Q and 30% Y/Y.

“The 1H’24 double-digit Y/Y growth for OLED panel shipments is welcome news that demand is strong for OLED applications. We expect healthy Y/Y growth to continue, fueled by increased demand in the commercial and consumer PC sector and AI innovations for several categories”, notes David Naranjo, Sr. Director.

OLED Panel Shipments and Y/Y Growth, Q2’22 – Q2’24

By OLED panel supplier, SDC continues to lead in OLED panel shipments with a 40% overall share, up from 37% in Q1’24, as a result of gains for several OLED applications with OLED tablets leading the growth with a 248% Q/Q increase. Q2’24 marks the first time that SDC has gained share after losing share or remaining flat for the past seven quarters.

The OLED Shipment Report – Flash Edition, includes historical panel shipments from 2016 through Q2’24 by application, by brand, by panel supplier, by OLED type and much more.

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.