Counterpoint Research, Displays

[email protected]

FOR IMMEDIATE RELEASE: 07/09/2025

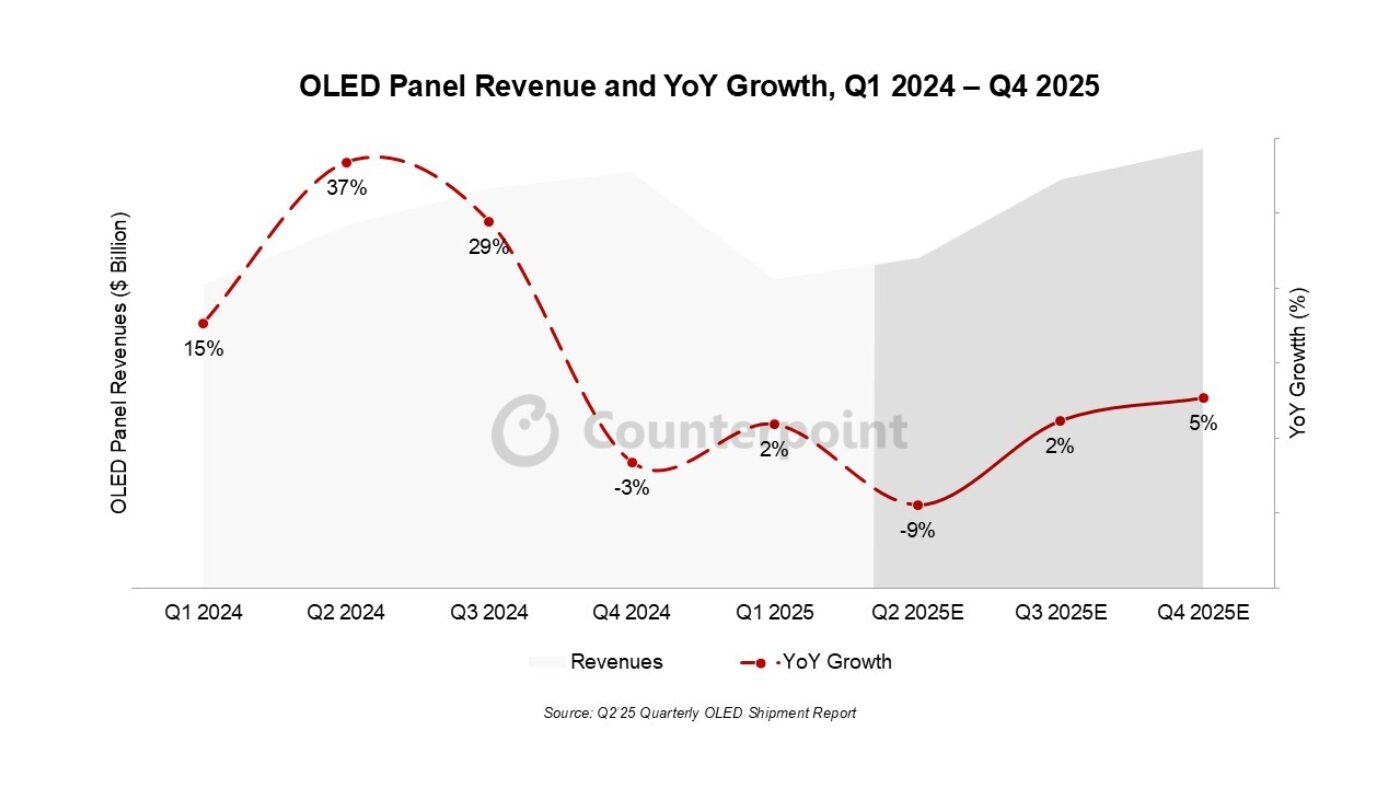

OLED Panel Revenues Up 2% YoY in Q1 2025; Outlook for 2025 Remains Flattish Amid Tariff, Macro Environment Concerns

Seoul, Beijing, Buenos Aires, Fort Collins, Hong Kong, London, New Delhi, Taipei, Tokyo -

- In Q1 2025, OLED panel shipments and revenues increased 4% YoY and 2% YoY, respectively.

- Most of the unit growth during the quarter was across TVs, tablets, monitors and smartphones, whereas OLED notebook PCs saw a decline.

- For the full year 2025, we forecast overall OLED panel unit growth of 4%. But revenues will remain flat mainly due to panel ASP declines across all applications, with the smartphone ASP declining 2% YoY.

OLED panel revenues increased 2% YoY in Q1 2025 after decreasing 3% YoY in Q4 2024, according to the latest release of Counterpoint Research’s OLED Shipment Report. This improvement in panel revenues was driven by the 4% YoY unit increase due to accelerated shipments in categories such as AR glasses, automotive, smartwatches, TVs and monitors. However, smartphones, the largest contributors to OLED revenues, saw their revenues flatten out, while notebook PCs saw negative growth.

“Q2 2025 will be a tough quarter. It will be followed by a recovery in the second half as new foldables and flagship products launch in the run-up to the holiday season. However, this will not be enough to offset the overall flattish revenue growth for the full year 2025,” noted Associate Director David Naranjo.

Naranjo added, “Smart device segments need a solid boost from the newer OLED-driven form factors, such as foldables and rollables, to go mainstream and reinvigorate the revenue growth. OLED adoption across AI PCs and tablets also slowed down compared to last year, which would have otherwise been a growth driver this year.”

OLED Panel Revenues and YoY Growth, Q1 2024 – Q4 2025

OLED panel growth summary for Q1 2025:

- OLED smartphone units increased by 1% YoY but remained flat in terms of revenue.

- Samsung Display (SDC) continued to be the largest supplier for iPhones, followed by LG Display and BOE, which is seeing good traction.

- Flexible OLED smartphone units grew 4% YoY while foldable OLED smartphone units remained flat.

- SDC holds the #1 position for flexible OLED and rigid OLED segments, whereas BOE has overtaken SDC for the #1 position for the foldable OLED segment.

- OLED TVs increased by 8% YoY in units and 3% YoY in revenues, but are still facing strong competition from MiniLED LCD TVs.

OLED monitors increased 68% YoY in units, while notebook PCs declined 18% in units.

For the full year 2025, we forecast overall OLED panel unit growth of 4%. But revenues will remain flat mainly due to panel ASP (average selling price) declines across all applications, with the smartphone ASP declining 2% YoY.

For a deep dive into the $50-billion OLED panel market, refer to our latest OLED Shipment Report, which includes quarterly tracking and forecasts for units, area, ASP, revenues, suppliers and brands by panel type across segments, including demand-side OLED product roadmaps and more.

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.