DSCC

[email protected]

FOR IMMEDIATE RELEASE: 01/29/2024

MiniLED Shipments Rebounded 20% in Q3’23, DSCC Report Reveals MiniLED Penetration Continues to Steadily Increase

La Jolla, CA -

The shipments of MiniLED displays returned to normal in the third quarter as inventory is eliminated and demand recovers. DSCC’s latest Quarterly MiniLED Backlight Technologies, Cost and Shipment Report revealed that MiniLED backlight shipments increased to 4.7M units in Q3’23, more than a 20% increase compared to Q2’23, and are expected to remain flat in Q4’23. The total shipments for MiniLED backlight panels will reach more than 19M units in 2024.

Some highlights from the latest report include:

At CES 2024, new MiniLED products were released to include:

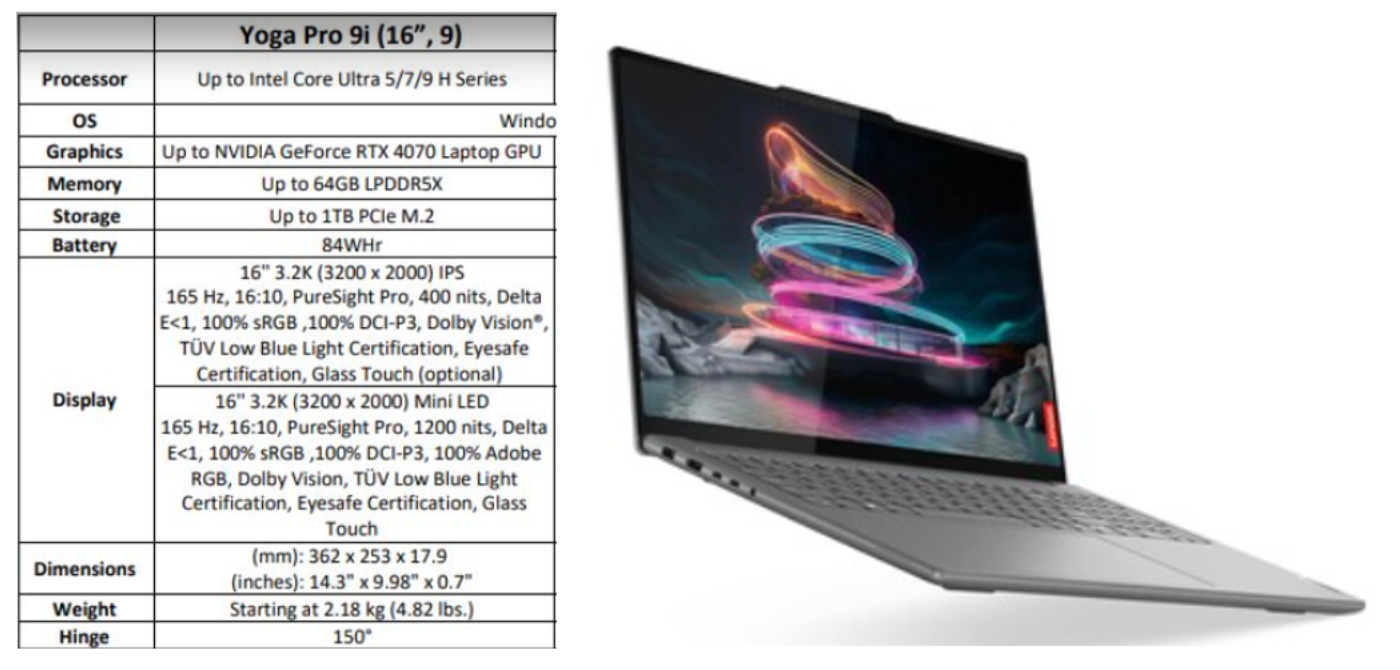

- Lenovo Yoga Pro 9i: 16” 3.2k(3200x2000) MiniLED Display

- Titan 18HX: Comes with an 18” 4K 120Hz MiniLED display, which provides a super high resolution, gorgeous color gamut and a high contrast ratio.

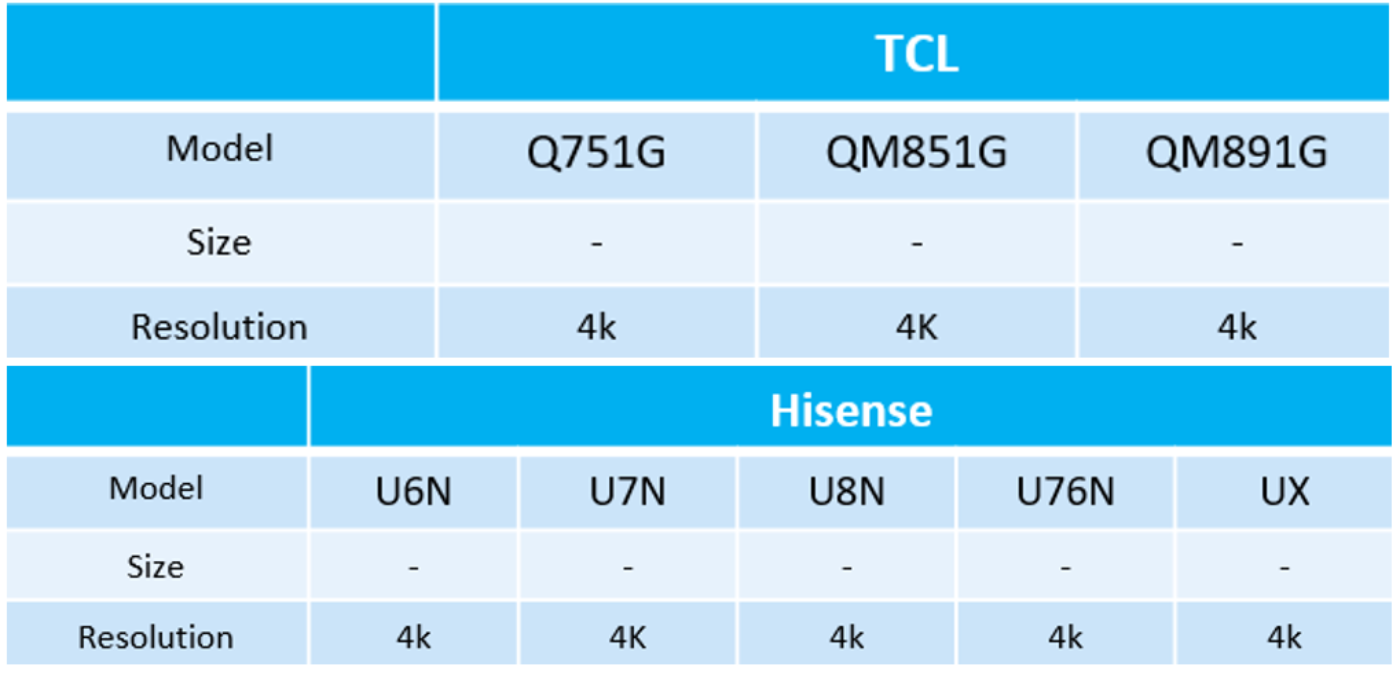

- Key TV brands will continue developing and releasing new MiniLED TVs in 2024.

- As expected, Apple continues to dominate MiniLED shipments. The MiniLED shipments from the iPad were 1M units and 1.3M units from the MacBook Pro in Q3’23.

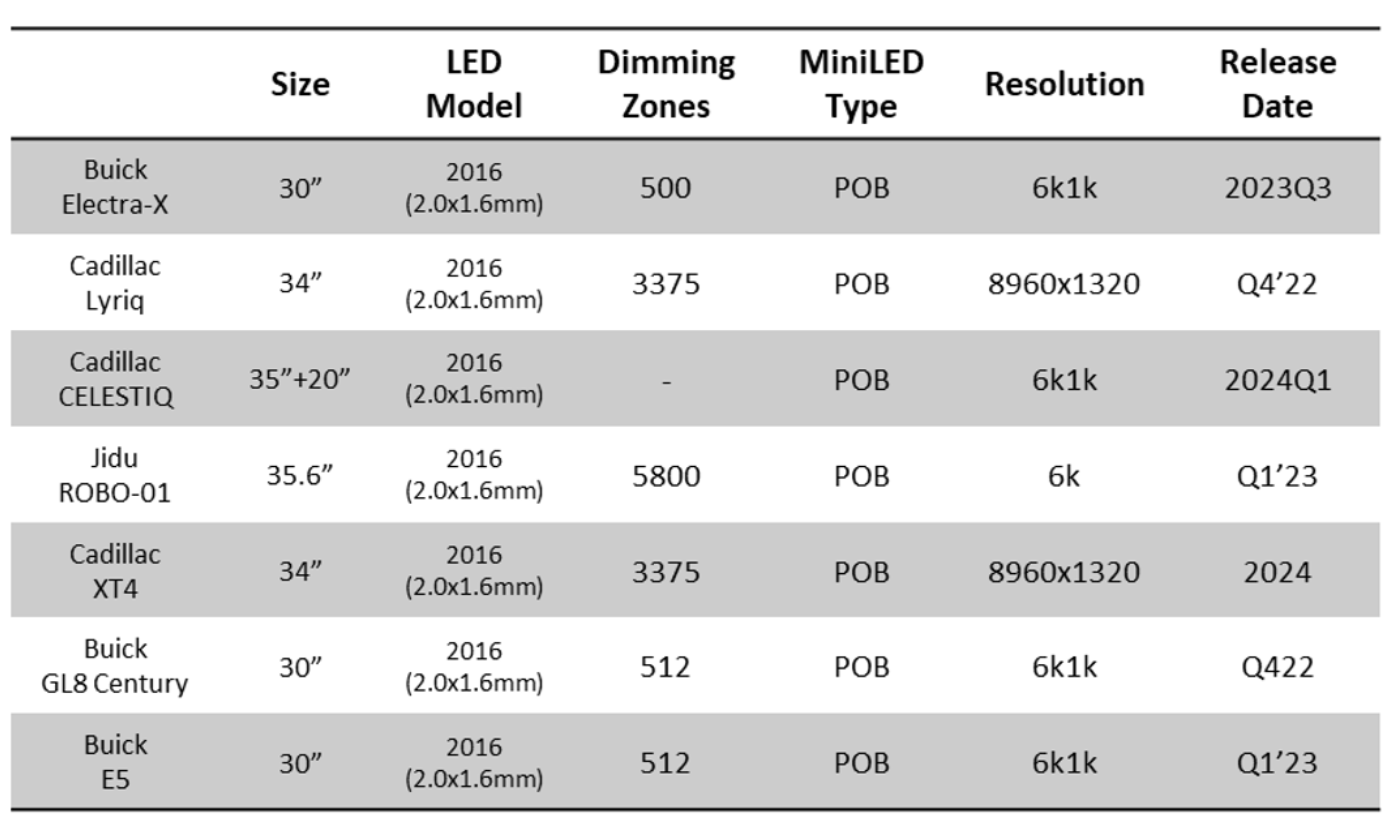

- The penetration of MiniLED in automotive displays continues to steadily increase. Most key players are very aggressive in adopting MiniLED backlights in interior displays. DSCC expects the penetration of MiniLEDs to reach 10% in automotive displays in 2025.

DSCC provides MiniLED Backlight shipments forecast to 2027 and updates quarterly shipments. DSCC expects:

- MiniLED panel shipments for all applications to reach 23.6M panels in 2027, up from 17M panels in 2023.

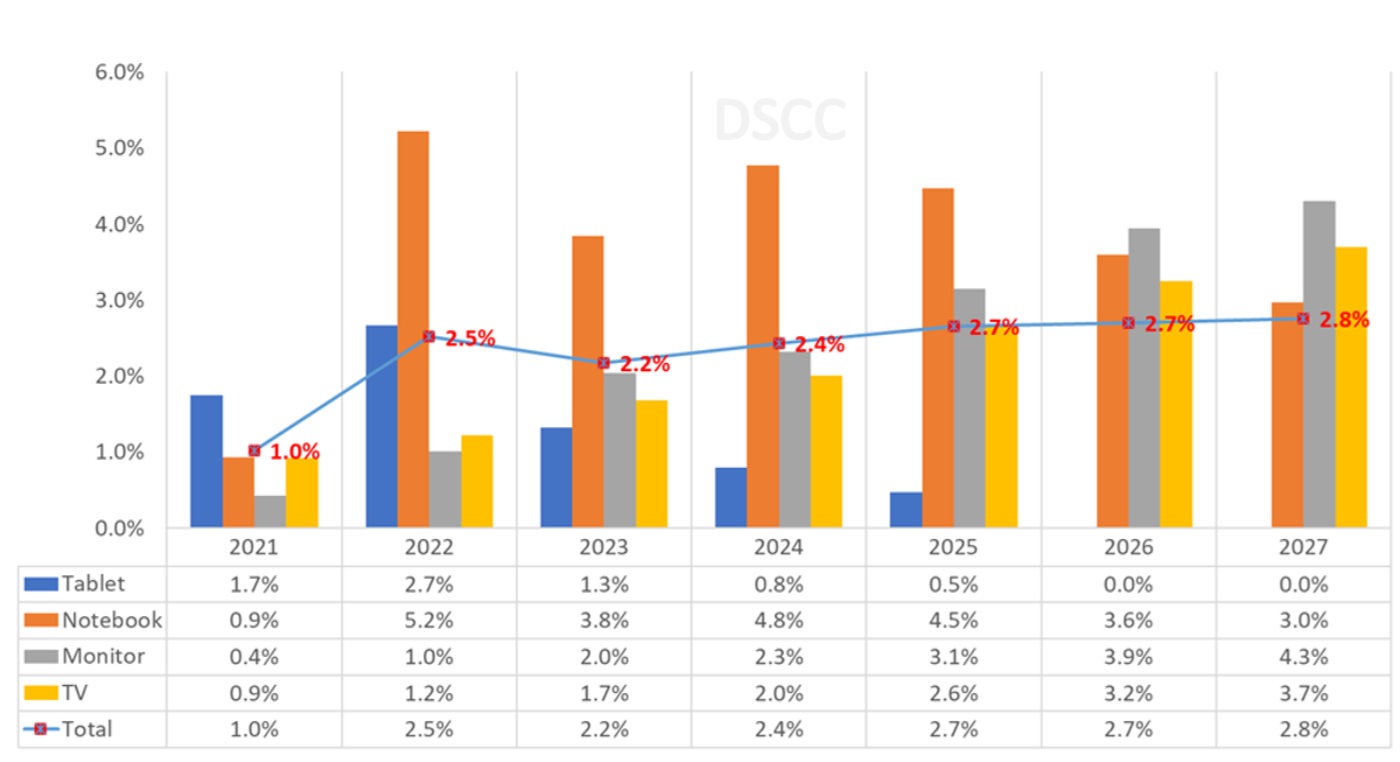

- Notebooks will be the main driving force for MiniLED growth before 2026, and the penetration in notebooks will be 3.8% in 2023 and are expected to reach 4.8% in 2024. TV and monitors will take over and become the main driving force after 2026.

- OLED will be adopted in iPad in 2024 and in the MacBook Pro before 2026. This will have a significant impact on MiniLED growth.

- Apart from IT and TV displays, MiniLED is beginning to penetrate many new applications applications, such as AR/VR, automotive, medical, direct-view displays, etc.

According to DSCC Director of Taiwan Operations, Leo Liu, “Although MiniLED continues to grow, there are still many challenges ahead. Facing the strong competition from OLED, cost reduction is the most important task for MiniLED to continue to grow. The entire supply chain (from LED, backplane, to optics and assembly) must work together to strive for a more affordable cost with optimum performance to meet market expectations. A comprehensive survey and unique perspectives about cost reduction are included in the latest MiniLED report.”

DSCC’s Quarterly MiniLED Backlight Technologies, Cost and Shipment Report includes quarterly through 2022 and annual data through 2027 by brand, model, panel size, resolution, refresh rate, backplane technology, # LED, dimming zones, etc., and includes panel shipments, supply chain shipments, panel revenues, backlight revenues, panel prices, backlight prices, backlight bill of materials and much more. For more information, please contact [email protected].

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.