DSCC

[email protected]

FOR IMMEDIATE RELEASE: 08/26/2024

iPhone 16 Series Panel Shipments Start Strong with 20% Higher Volumes than the iPhone 15 Series in July

La Jolla, CA -

• Through July, cumulative iPhone 15 series panel shipments were higher than iPhone 14 series.

• On a M/M basis in July, Phone 15 series panel shipments continued to decline.

• Initial iPhone 16 series panel shipments are 20% higher than initial iPhone 15 series shipments.

As we approach the end of August and with a few weeks to go until Apple announces the iPhone 16 series, the latest release of the Monthly Flagship Smartphone Display Tracker shows that cumulative panel shipments through July for the iPhone 15 Series were 6% higher in 2023 – 2024 versus the iPhone 14 series during the same period in 2022 - 2023. On a M/M basis for July, the iPhone 15 series decreased 44% M/M.

In July, panel shipments started for the iPhone 16 series. Panel shipments for the iPhone 16 series in July were 20% higher than the iPhone 15 series for June and July in 2023.

The iPhone 16 series is expected to have a number of improvements that include:

- A larger screen size for the iPhone 16 Pro and iPhone 16 Pro Max of 6.27” and 6.86”, respectively;

- A new capture button, the action button for all iPhone 16 models (the action button was limited to the iPhone 15 Pro models);

- The A17 Bionic chipset for the standard models and the A18 Pro chipset for the Pro models;

- A vertical camera lens for the standard models;

- Thinner bezels;

- New M14 OLED material for the iPhone 16 Pro and iPhone 16 Pro Max.

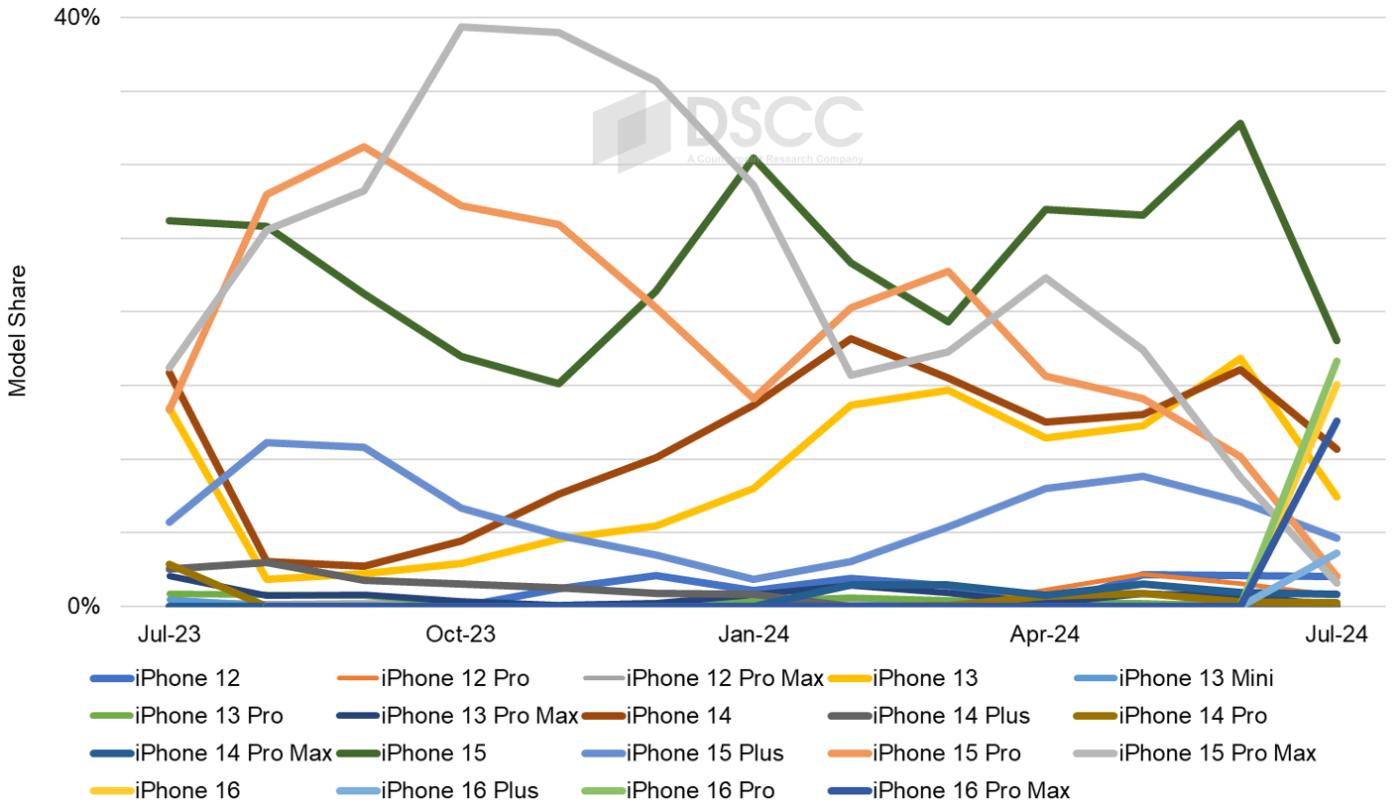

iPhone Share by Models – July 2023 – July 2024

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.