DSCC

[email protected]

FOR IMMEDIATE RELEASE: 10/28/2024

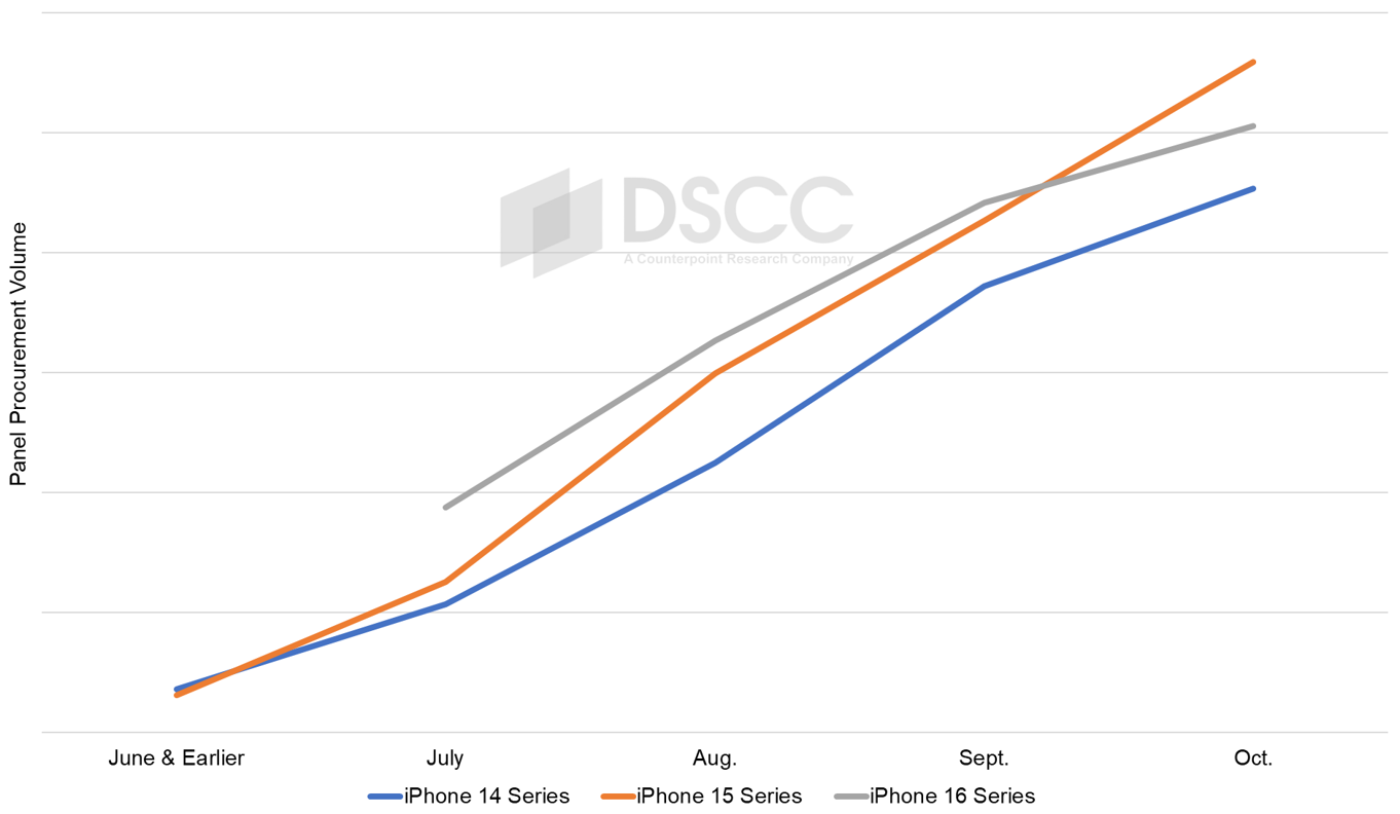

iPhone 16 Series Panel Procurement Projected to be 1% Higher than the iPhone 15 Series Through October

La Jolla, CA -

- Through September, the cumulative iPhone 16 series panel procurement was 8% higher than the iPhone 15 series.

- For the iPhone 16 series, iPhone 16 Pro models accounted for a 66% cumulative share in September.

- Through October, the iPhone 16 series panel procurement is expected to be 1% higher versus iPhone 15 series.

As we approach the end of October and with the iPhone 16 series being available since September 20th, our latest release of the Monthly Flagship Smartphone Display Tracker shows that cumulative panel procurement through October for the iPhone 16 Series is tracking 1% higher versus the iPhone 15 series during the same period in 2023. Panel procurement for the iPhone 15 series started in June 2023, while panel procurement for the iPhone 16 series started in July 2024.

In addition, similar to previous years during the months of January – October, we see more panel procurement for entry level models such as the iPhone 13, iPhone 14 and iPhone 15 as Apple continues to target emerging markets. Apple is expected to announce their FY Q4’24 earnings on October 31st.

With the current mix of panel procurement volume for the iPhone 16 series, the iPhone 16 Pro models accounted for a 66% cumulative share in September versus a 60% cumulative share for the iPhone 15 Pro models during the same time period in 2023.

The chart here represents historical panel procurement for the iPhone 14 and iPhone 15 series during their respective months of June – October leading up to their launch and our historical panel procurement for the iPhone 16 series through September and our estimate for October 2024.

iPhone Panel Procurement by Series by Month: June - October

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.