Counterpoint Research, Displays

[email protected]

FOR IMMEDIATE RELEASE: 04/15/2025

Increased Quantum Dot Adoption in Displays Drives Double-digit Revenue Growth in 2024

Seoul, Beijing, Buenos Aires, Hong Kong, London, New Delhi, San Diego, Taipei, Tokyo -

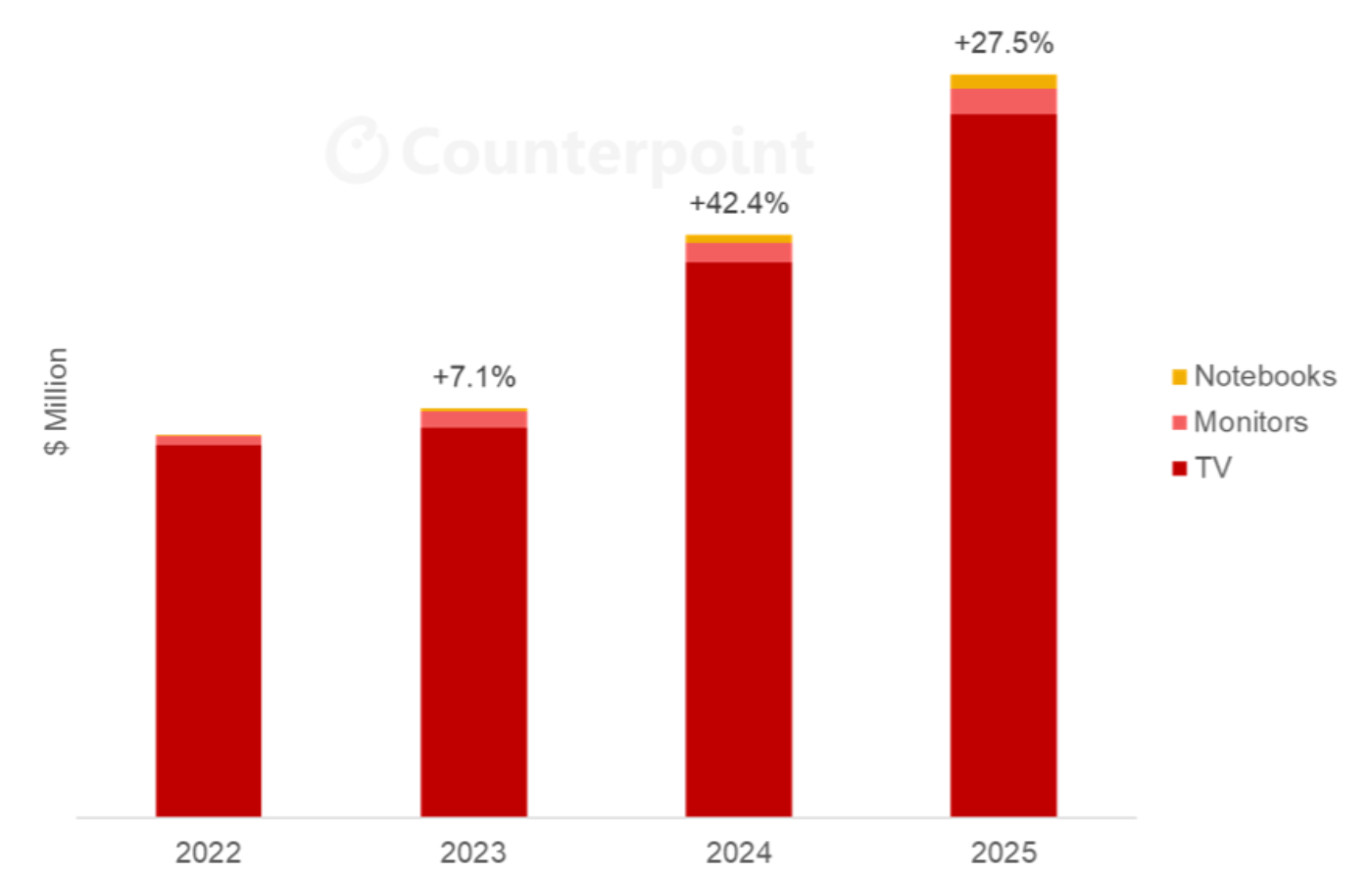

- The market for quantum dot films and diffuser plates increased 42% YoY in 2024.

- The key driver was QD-LCD and MiniLED TVs which accounted for the bulk of the market.

- We expect double-digit growth to continue in 2025, despite controversy over low-concentration films in some TVs.

- Notebooks and monitors to grow at an even steeper rate but will remain a small segment of the QD market.

- However, the new US tariffs will curb demand for premium displays if they become permanent.

- Material revenues in QD-OLED panels increased 38% YoY but are expected to decline in 2025 as Samsung Display improves quantum dot ink utilization.

Revenues for quantum dot film and diffuser plates grew 42% YoY in 2024, according to Counterpoint Research’s Quantum Dot Display Technology and Market Outlook Report. The sharp increase was driven by QD-LCD and MiniLED TVs. While the notebook segment remained relatively small last year, revenues increased 228%, thanks in part to Apple finally adopting quantum dots in its MacBook Pro.

“At the end of last year, we revealed that the new M4 MacBook Pro used quantum dots instead of phosphors”, said Guillaume Chansin, Associate Director at Counterpoint Research. “Apple never had quantum dots in its displays before, so this decision showed that the technology had met its performance and cost requirements. This also solidified quantum dots as the best color conversion solution for high-end MiniLED displays.”

QD Film/Plate Revenues

However, there is a controversy that has rocked the industry in recent months. Several TV brands have been accused of misleading consumers by using negligible amounts of quantum dots in models clearly labeled as “QLED” or “Quantum Dot MiniLED”. Two class-action lawsuits have been filed in the US against TCL and Hisense, which could undermine confidence in their products in the short term. This could also lead to more transparency from TV makers and a standardized definition for QLED. Despite the controversy, demand for quantum dot films and diffuser plates is still expected to grow, with an estimated 27.5% YoY increase in 2025 revenues.

However, the newly imposed tariffs in the US are set to make a dramatic impact on imports from Asia, including TVs. If the tariffs are maintained for a prolonged time, retailers will have to increase prices, which will curb demand for premium displays. At this time, there is still no clear visibility on the level and duration of tariffs.

Quantum dots are also found in QD-OLED panels manufactured by Samsung Display. Thanks to additional production capacity, revenues for quantum dot materials in QD-OLED increased by around 38% in 2024. Although Samsung Display has announced plans to increase shipments of monitor panels by 50% in 2025, capacity remains limited and so we expect lower shipments of TV panels. The company has also started to implement an ink recycling technology to reduce its consumption of quantum dots. As a result, material revenues are expected to decline in 2025.

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.