Counterpoint Research, Displays

[email protected]

FOR IMMEDIATE RELEASE: 08/14/2025

Global Display Equipment Spending to Climb to $76 Billion During 2020-2027

Seoul, Beijing, Berlin, Buenos Aires, Fort Collins, Hong Kong, London, New Delhi, Taipei, Tokyo -

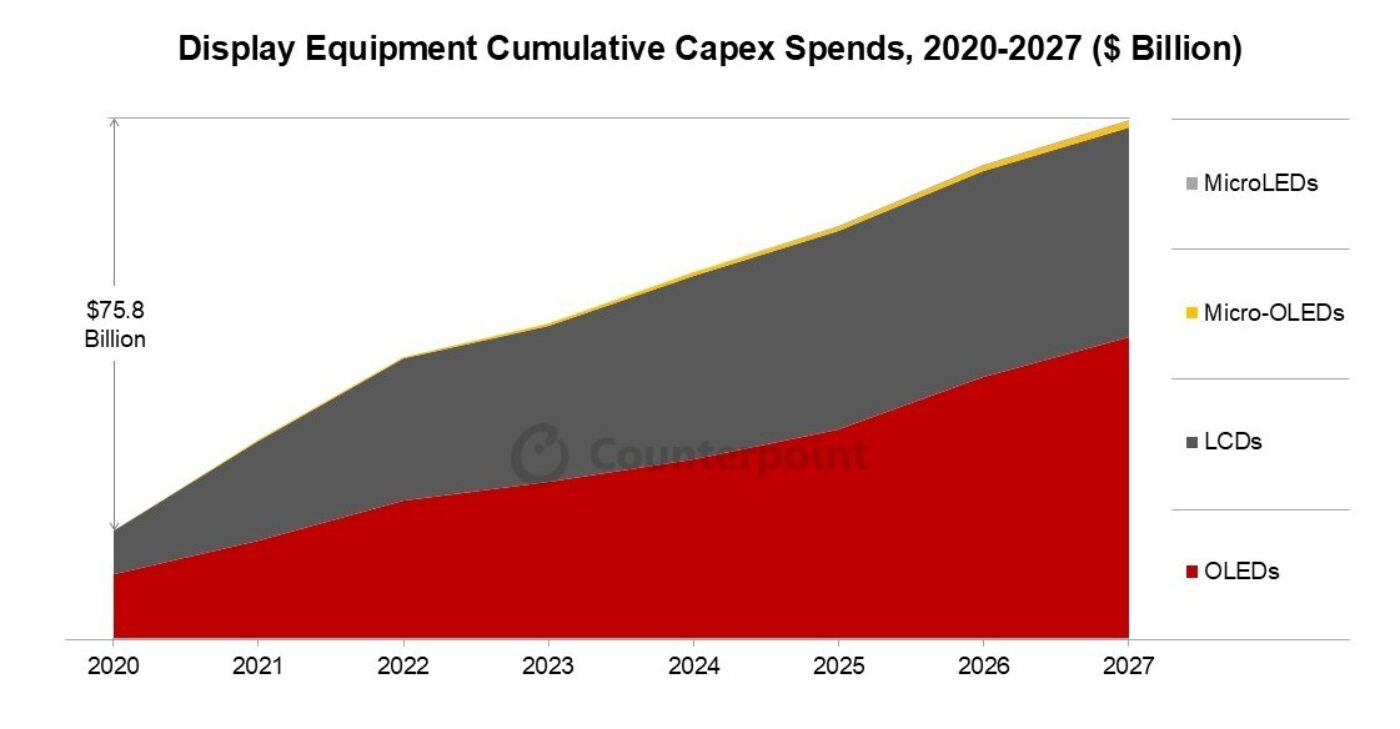

- Display equipment spending is expected to reach a cumulative $76 billion during 2020-2027.

- OLED will continue to contribute the lion’s share of these capex investments, with 31% YoY growth in 2025 alone.

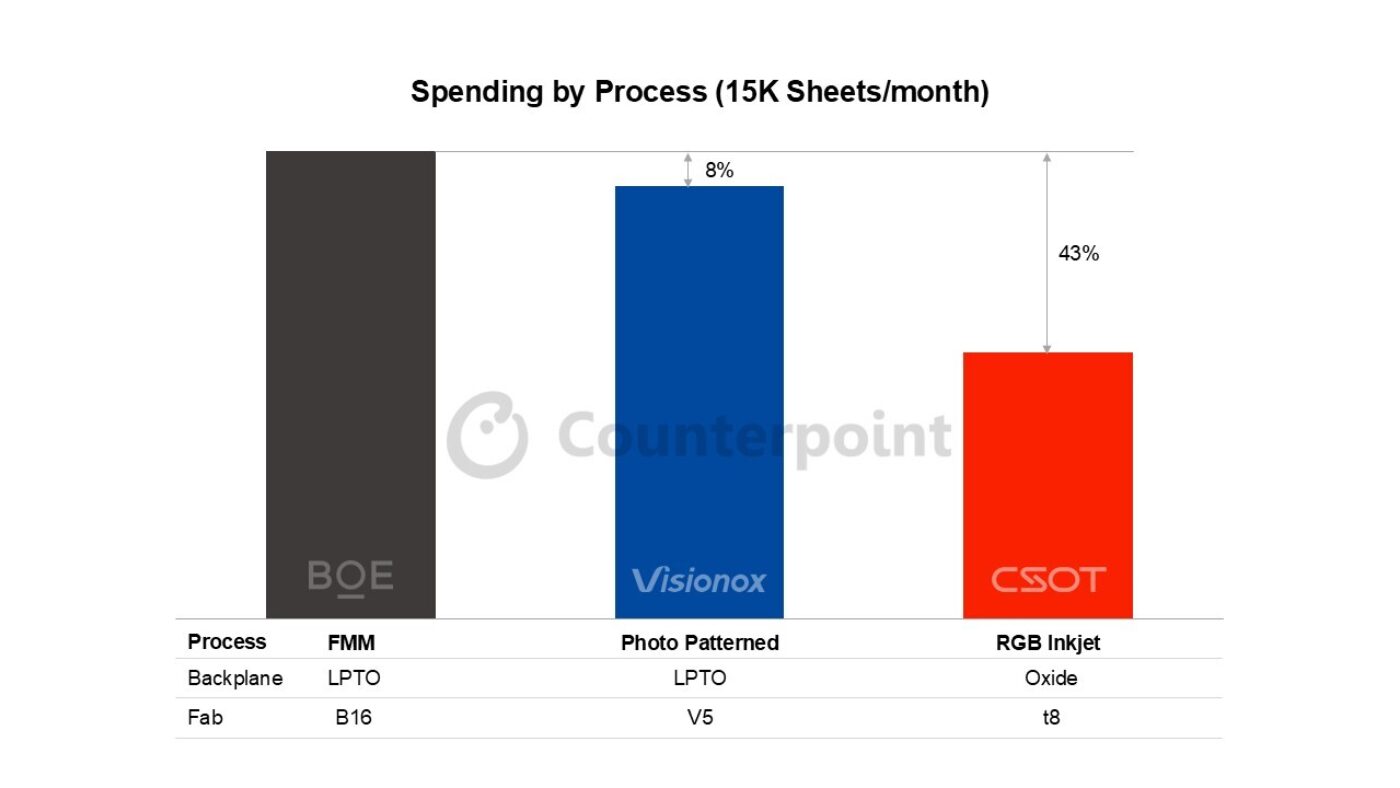

- Visionox and CSOT are expected to adopt a new deposition method for OLED, which is currently the talk of the town. However, the capex difference between Photo Patterned OLED and Fine Metal Mask (FMM) is negligible.

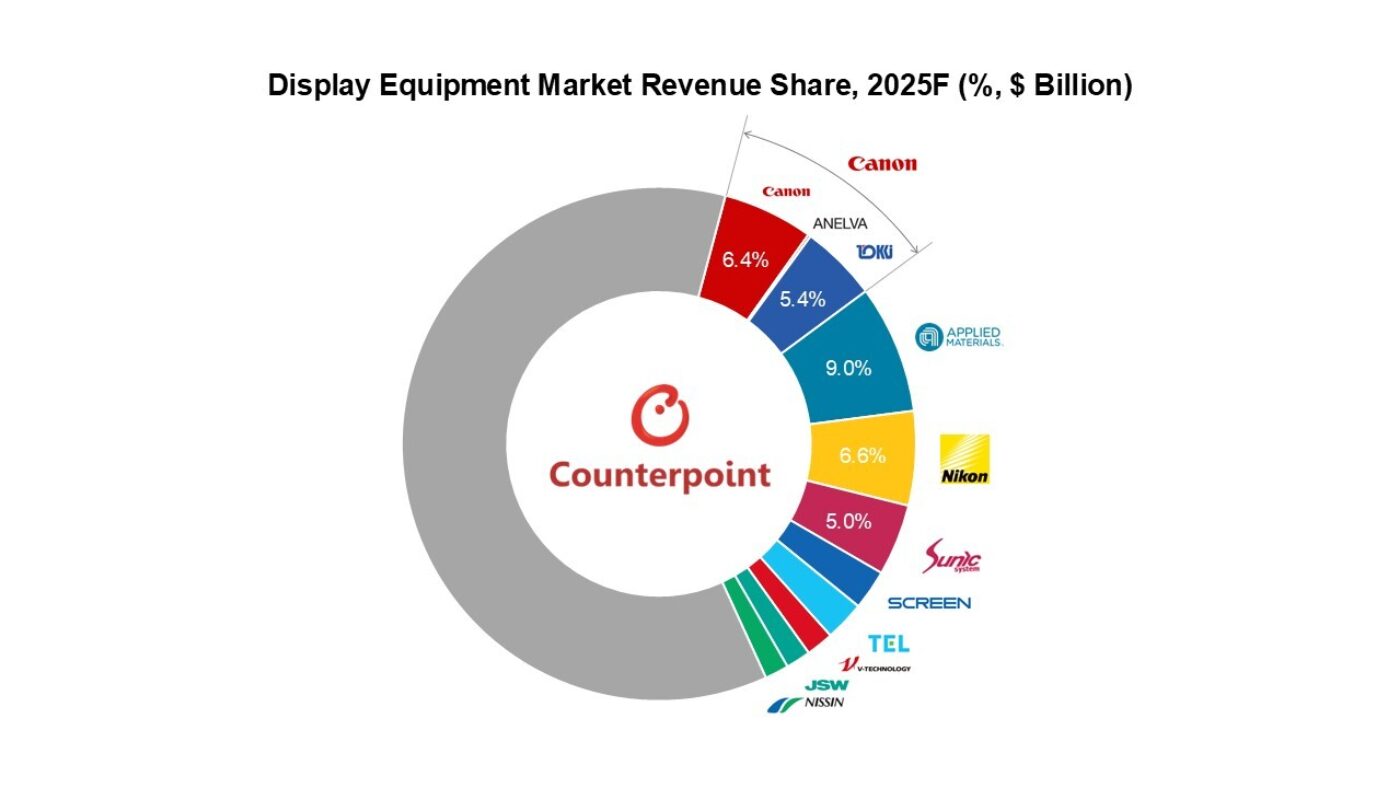

- Canon (including Tokki and Anelva), Applied Materials and Nikon are expected to continue leading the display equipment market, with a combined revenue share of 28%.

With the growing demand for OLED and LCD displays from the IT, automotive and mobile phone sectors, as well as emerging categories such as XR (AR/VR/MR), display manufacturers have been ramping up their equipment capex. Global display equipment spending for the 2020-2027 period is expected to reach a cumulative $75.8 billion, according to the latest Quarterly Display Capex and Equipment Market Share Report, part of Counterpoint Research’s Display 360 Service.

Spending by technologies and key new processes

The major technologies driving these significant capex investments are OLED, followed by LCD and Micro-OLED. In 2025, OLED-related equipment spending is expected to increase by 31% YoY, while LCD spending is projected to decline by 45% YoY. From 2025 to 2027, OLED is forecasted to account for 80% of total investments, driven by new Gen 8.7 IT OLED and Gen 6 technologies, while LCD is expected to slip to a meagre 17% share.

Until now, most OLED manufacturers with Gen 6 (1500x1850 mm) fabs have expanded to Gen 8.7 (2290x2620 mm) without changing the method of deposition, backed by stable yields and advancements in Fine Metal Mask (FMM) technology.

However, China’s Gen 8.7 panel suppliers are looking to adopt technologies other than FMM. Senior Analyst Jayden Lee said, “Visionox’s V5 fab has selected Photo Patterned OLED technology, while CSOT’s t8 line is likely to adopt RGB Inkjet OLED. Unlike conventional FMM, this shift in evaporation methods is seen as an effort to secure both a competitive edge and cost advantages for next-generation OLED panels.”

Counterpoint Research closely tracks the capex investments and highlights the advantages and disadvantages of different process technologies in its quarterly Display Capex Report. Highlighting recent research findings on FMM, mask-less (Photo Patterned) and RGB Inkjet technologies, Lee noted, “At this point, we don’t see a significant capex difference between the FMM and Photo Patterned processes adopted by BOE and Visionox, respectively. However, there are some caveats that will influence the overall capex investments for these processes over time. TCL CSOT’s approach with inkjet scores well on lower costs but will need to improve inkjet resolution moving forward to scale across key categories. This will be critical for China-based display vendors to continue challenging their South Korean counterparts.”

Key equipment makers capturing display capex investments

The display equipment supply chain is long and fragmented, unlike that of semiconductor fab equipment. We track more than 170 different equipment vendors in the display equipment supply chain. Japanese equipment makers have been dominating this industry, but signs of consolidation have emerged with each generation, along with the rise of new suppliers, thanks to the geopolitical climate and the rise of China-based supply chains to support local manufacturers.

Canon (including Anelva and Tokki) is expected to continue leading the market, with its revenues projected to grow 9% YoY and capture 12% market share in 2025. Applied Materials will see its market share slip a bit to 9% but it will remain the second-largest display equipment maker in terms of revenue. Nikon will also see its market share erode, with revenues forecasted to decline 22% YoY this year.

Sunic, Nissin, Screen, Viatron and Suzhou Xinda are among the companies growing faster than the market and rapidly capturing share from incumbents. Among the top 20 companies, 8 are from Japan, 7 from South Korea, 4 from China, and 1 from the US.

The above-mentioned report includes all of Counterpoint’s content on OLED, LCD, and Micro-OLED fab schedules, OLED and LCD capacity, and LCD, OLED, and Micro-OLED equipment market sizes, market shares, and forecasts for 80 different segments. All design wins and units by fab by equipment type are shown and quarterly revenues are provided for over 130 different display equipment suppliers. Also included are typical process flows for each major process.

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.