DSCC

[email protected]

FOR IMMEDIATE RELEASE: 05/31/2022

Foldable Smartphones Continued to Surge in Q1’22, Strong Growth Expected in 2022

Austin, TX -

Foldable smartphone shipments rose 571% Y/Y in Q1’22 to 2.22M. It was the 3rd best quarter to date for the rapidly growing category, but was down 47% Q/Q from the record high of 4.2M units in Q4’21.

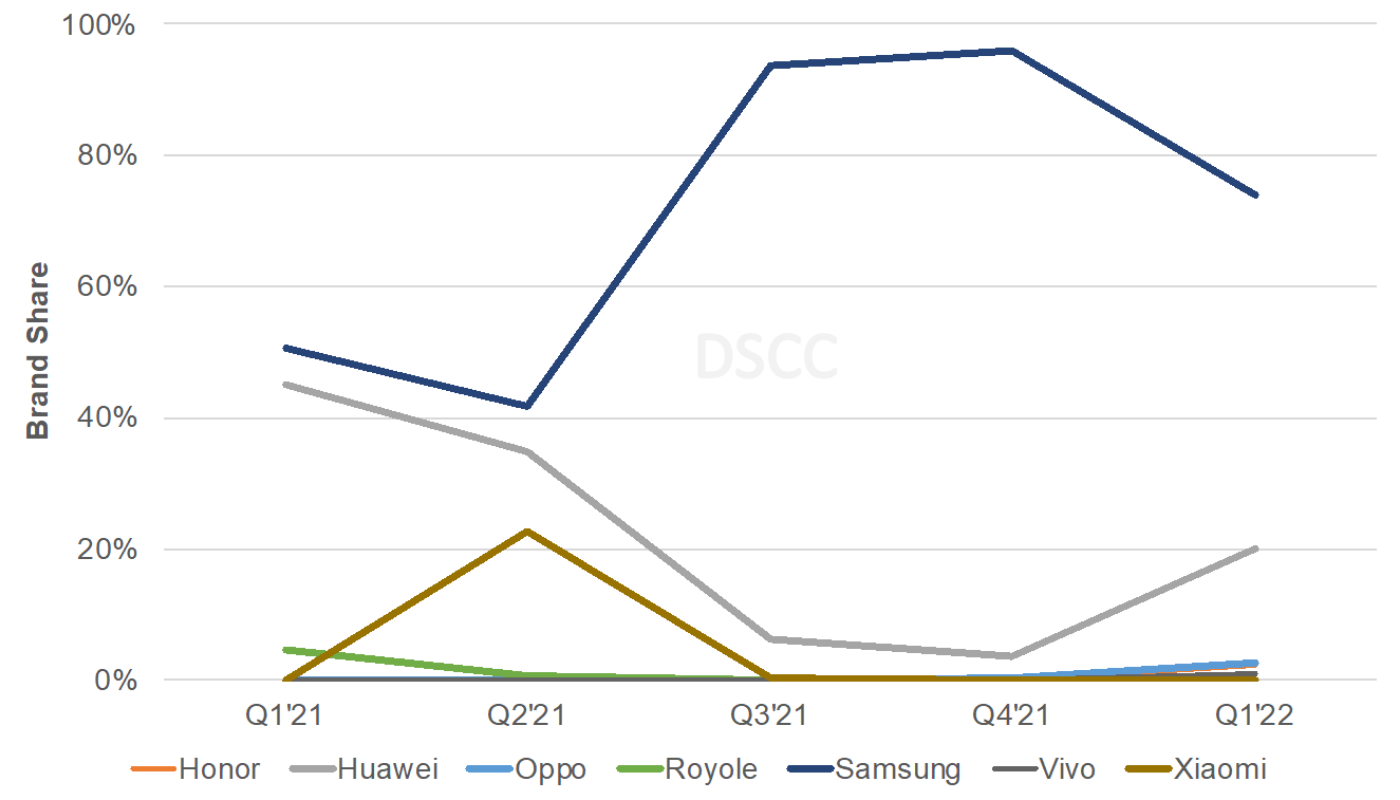

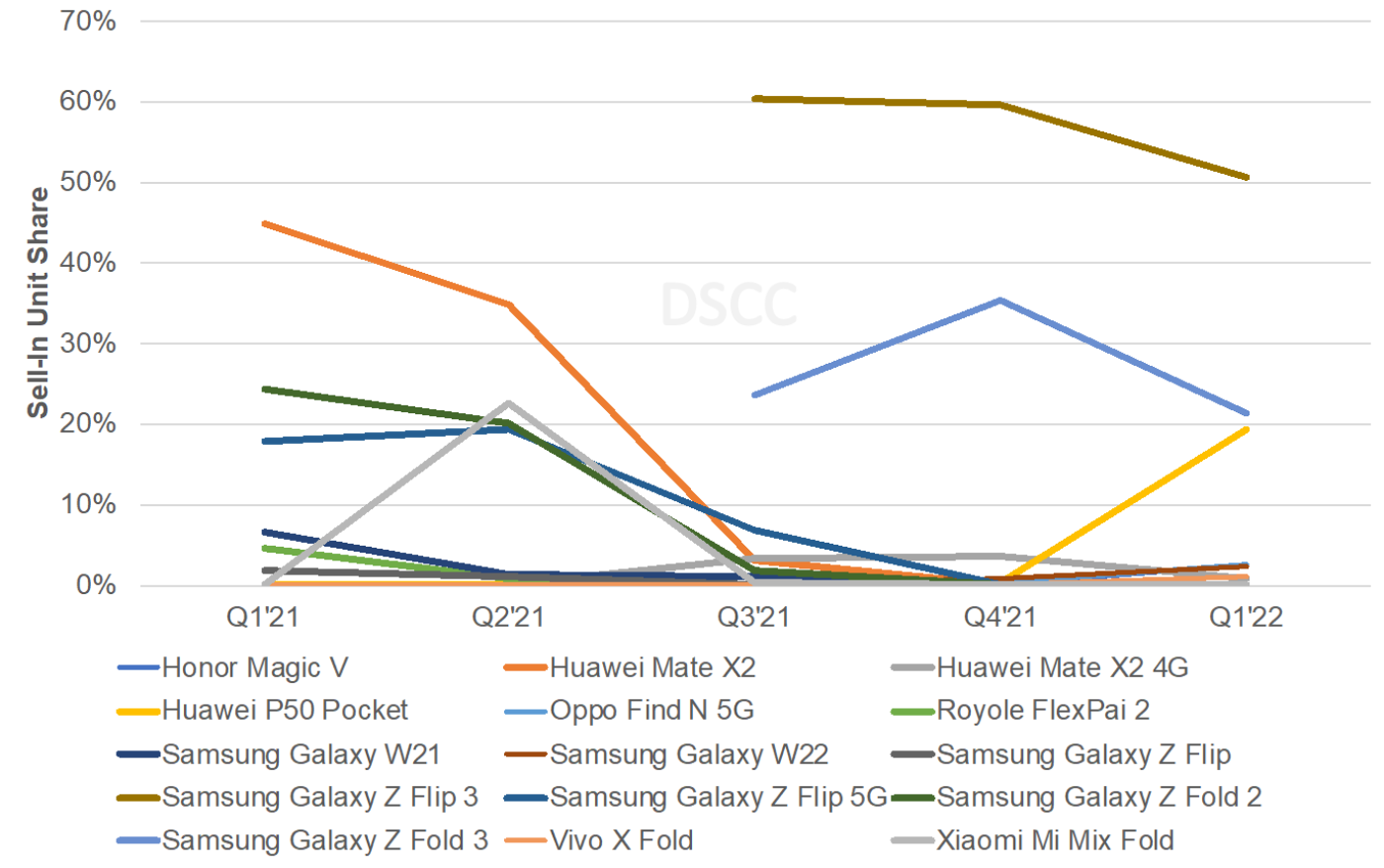

Samsung continued to dominate the category, but its share fell to 74% with Huawei’s share rising to 20%. No other brand had more than a 2% share. By model, the Samsung Galaxy Z Flip 3 led the market for a 3rd straight quarter, earning a 51% share. The Galaxy Z Fold 3 remained #2 for the 3rd straight quarter, but was nearly overtaken by the Huawei P50 Pocket. Those three models accounted for a 91% share with no other model having more than a 2.5% share. Clamshell models like the Z Flip 3 and P50 Pocket accounted for a 70% share, its highest share since Q3’20.

Foldable Smartphone Shipments by Brand

Foldable Smartphone Shipments by Model

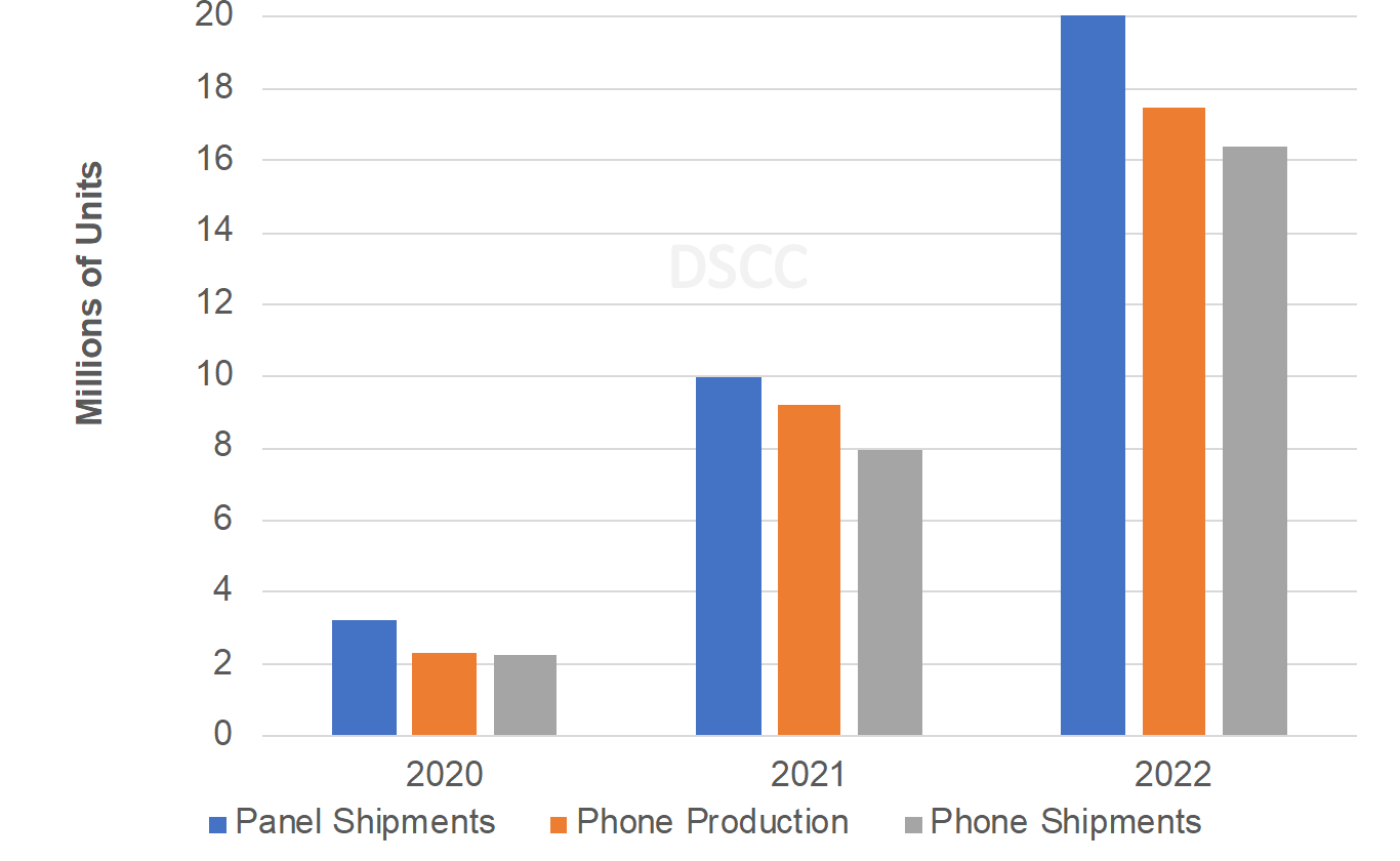

According to report author and DSCC co-founder and CEO Ross Young, “While 2022 will be a challenging year for most display applications, foldable smartphones will see strong growth. We expect a 107% increase in foldable smartphone shipments to over 16M units with 102% increase in foldable smartphone panel shipments to over 20M. Driving the growth will be Samsung’s ambitious plans for its upcoming Z Flip 4 and Z Fold 4 launch as well as contributions from new models in 2H’22 from three other brands. One of the interesting developments to watch in 2022 will be how the Fold 4 performs. We believe Samsung has recently increased its expectations for this product and is expecting faster growth for the Fold 4 vs. the Flip 4 which likely signals a lower launch price than last year’s $1799."

2020-2022 Foldable Panel Shipments, Phone Production and Phone Shipments

The latest report also reveals foldable notebook PC developments with new brands and sizes added on confirmed programs as well as the pause of LG’s rollable TV shipments.

DSCC’s Quarterly Foldable/Rollable Display Shipment and Technology Report reveals monthly and quarterly foldable device and panel shipments through 2022 and annual data through 2026 by brand, model, panel size, refresh rate, backplane technology, cover window material, UTG and CPI supplier, notch vs. hole vs. UPC, polarizer supplier, hardcoat supplier, touch sensor supplier, fingerprint recognition type, chipset, chipset supplier, number of cameras, network type, etc. It also reveals the supply chain by model for all applications, Samsung’s regional production, panel and device revenues, panel and device prices, current and forecasted panel bill of materials, display technology advancements and film stacks/device cross sections. For more information, please contact [email protected].

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.