DSCC

[email protected]

FOR IMMEDIATE RELEASE: 12/23/2024

DSCC’s FOPLP and Glass Substrate Packaging Report Reveals Significant Growth Opportunities

La Jolla, CA -

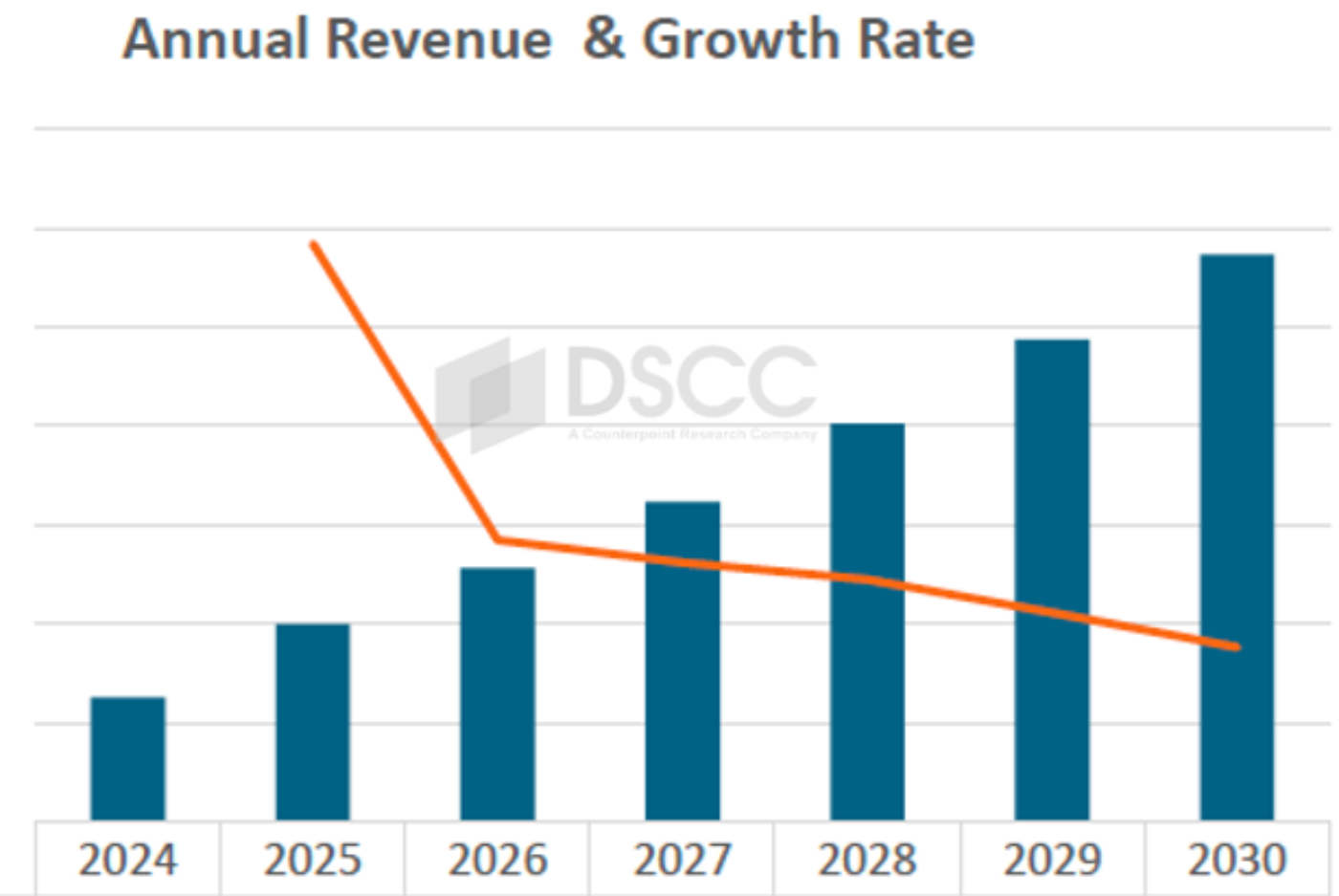

- The Fan Out Panel Level Packaging (FOPLP) market, which includes glass substrate packaging (GSP), is expected to grow at a 29% CAGR to $2.9B.

- Numerous applications will benefit from FOPLP, including AI, HPCs, Communication, Automotive, Displays, etc. AI and HPCs are expected to lead from 2026.

- Companies throughout the semiconductor and display supply chains are poised to benefit from the shift to FOPLP and GSPs.

DSCC, a Counterpoint Research Company, has released its 2024 FOPLP and Glass Substrate Packaging Report, highlighting significant advancements and growth trends in advanced packaging that will impact both the semiconductor and display supply chains.

The 200+ page report forecasts and analyzes all major advanced semiconductor packaging approaches out to 2030. The report provides detailed:

- Technology descriptions;

- Process flows;

- Capacity forecasts;

- Demand forecasts;

- Shipment forecasts in units, area, revenues by application and technology.

The Fan Out Panel Level Packaging (FOPLP) market, which includes glass substrate packaging (GSP), is expected to grow at a 29% CAGR to $2.9B.

The rapid adoption of FOPLP is fueled by rising demand in:

- Artificial Intelligence (AI) and High-Performance Computing (HPC) markets, which require advanced packaging solutions for higher performance, scalability and energy efficiency. FOPLP enhances data bandwidth and thermal performance, crucial for GPUs, CPUs and ASICs. Devices are becoming so complex and large that chipmakers and packaging suppliers are turning to new packaging approaches including glass substrates and FOPLP. Advantages of glass substrates include superior flatness and better thermal and mechanical stability which will allow for higher density and higher performance chip packages to support AI. Glass substrates enable more transistors to be connected in a single package and also enable the ability to assemble larger configurations of chiplets.

- Automotive Electronics: Ideal for PMICs, sensors and ADAS systems, enabling reliability and compact designs.

- Displays: GSP (S-PLP) has emerged as a key enabler for MiniLED/MicroLED displays and Micro OLEDs tailored for AR/VR) applications. A GSP (S-PLP) allows for higher dimensional stability (especially in the reflow process) and lower warpage as opposed to organic substrates. These two key advantages can improve transfer yield and reliability and can have finer pitch of pads to mount smaller LEDs. GSP can also be used for Micro OLEDs on glass.

Companies across the semiconductor and display supply chains, including foundries, outsourced semiconductor assembly and test (OSAT) providers, panel manufacturers and PCB suppliers, are actively exploring FOPLP opportunities. These players recognize the importance of aligning their strategies and technological investments to remain competitive in this rapidly evolving market.

Key challenges include standardization of panel sizes, warpage control and equipment readiness. Breakthroughs in materials, such as low-CTE glass and advanced bonding techniques, will determine FOPLP’s scalability.

Major players like TSMC, Intel, Samsung, ASE, AUO and Innolux are heavily investing in FOPLP to expand capacity and applications. Emerging partnerships and pilot production lines signal readiness for mass adoption.

According to the report co-authored by an advanced semiconductor packaging expert in Taiwan with many years of experience, “FOPLP is at the forefront of the semiconductor industry’s evolution, providing cost-effective, high-performance solutions for AI and HPC applications. As materials and processes mature, we expect FOPLP to revolutionize packaging technologies across numerous industries. Due to the use of glass substrates, companies in the display supply chain are well positioned to capture some of this opportunity.”

For more information about this report, please contact [email protected] and visit the report description here.

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.