DSCC

[email protected]

FOR IMMEDIATE RELEASE: 01/29/2024

DSCC Releases New Smartwatch Shipment and Technology Report with Significant Insights for OLEDs and MicroLEDs

La Jolla, CA -

DSCC released the inaugural issue of its Quarterly Smartwatch Shipment and Technology Report last week and it packs a tremendous amount of insights for the smartwatch market.

Sony introduced the first OLED smartwatch in 2012 using a 1.3” OLED display, followed by Samsung in 2013 with a 1.63” OLED display. Since then, more than 20 brands have OLED smartwatch offerings. According to DSCC Senior Director David Naranjo, “DSCC expects OLED smartwatches to grow by an 8% CAGR from 2022 – 2028 as panel ASPs decline by a 7% CAGR. MicroLEDs are the latest technology frontier that is expected to be used for smartwatches in the coming years. Today, MicroLEDs are commercialized for large displays such as the 140” TV by Samsung and in development for AR, automotive and smartwatch applications. DSCC expects several brands to introduce a MicroLED smartwatch in 2025 and in 2026.”

This new report tracks OLED and MicroLED smartwatch panel shipments by panel supplier, brand, form factor, display size, panel ASPs and panel revenues as well as forecasts for OLED and MicroLED smartwatches. In addition, it provides insight into technology and innovation trends in OLED and MicroLED display technologies, which are applicable to smartwatches. The report tracks more than 25 brands which include Apple, Garmin, Google, Fossil, Honor, Huawei, Oppo, Samsung, Vivo, Xiaomi and much more.

The Smartwatch Shipment and Technology Report serves as an excellent tool for all companies involved in the OLED and MicroLED smartwatch supply chain: display material companies and manufacturers, panel suppliers, OEMs, technology developers, brands, telecom companies and financial analysts, etc.; by having the ability to see historical panel shipment results and forecasts along with upcoming models to be launched in the near future.

Some additional highlights of the report include:

- Q3’23 panel shipments increased 47% Q/Q and decreased 11% Y/Y as a result of 113% Q/Q from Garmin, 106% Q/Q growth from Honor, 95% Q/Q growth from Apple and 46% Q/Q from Samsung.

- Apple remained in the #1 position with a 40% unit share, up from 30% in Q3’23 followed by Huawei with 12%, down from 21% in Q2’23, Samsung with 10% and Xiaomi with 9%, down from 11% in Q2’23.

- In 2023, we expect Apple to continue to lead with a 35% share, followed by Samsung with 7%, Huawei with 13% and Google with 1%.

- Insight into OLED and MicroLED Panel Supplier Roadmaps.

- MicroLED Cost Analysis (available in the Deluxe Edition).

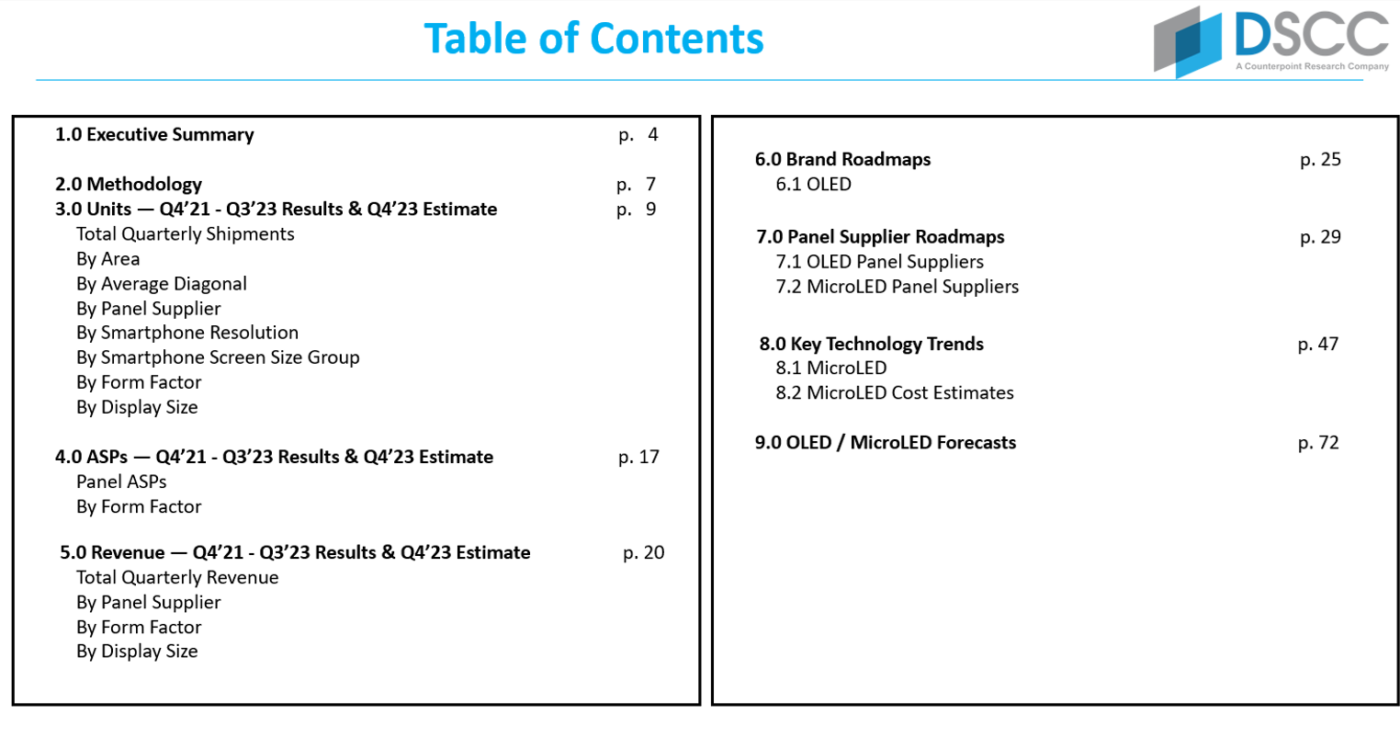

The table of contents for the deluxe edition, which includes MicroLED cost modeling is shown here:

Readers interested in a complimentary sample or pricing details of the Smartwatch Shipment and Technology Report, please contact [email protected].

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.