Ross Young

[email protected]

FOR IMMEDIATE RELEASE: 09/06/2018

DSCC Forecasts OLED Revenue to Grow to $50 Billion in 2022

Austin, TX -

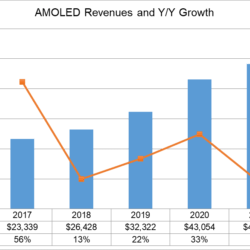

OLED revenues are expected to grow from $26 billion in 2018 to $50 billion in 2022, according to Display Supply Chain Consultants’ (DSCC) Quarterly OLED Shipment and Fab Utilization Report. OLED displays are experiencing rapid growth as consumer devices migrate from rigid to flexible and foldable designs. The growth rate for flexible OLEDs is forecast to grow 32% from 2018 to 2022.

Samsung Display continues to take the dominant market share of mobile OLED shipments, with a 91% share in the second quarter of 2018. However, the company will lose share over the long term as other panel makers become more aggressive in their OLED production and promotions.

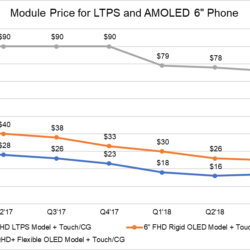

“So far, Chinese OLED panel makers have not been competitive with Samsung Display’s OLED production,” said Bob O’Brien, Co-Founder and President of DSCC. “Samsung Display offers several low-priced solutions in the Chinese market, and these have helped drive rigid OLED volume in the second quarter of 2018.”

Flexible OLED revenue share fell to 44% of OLED phone panel shipments in the second quarter, but it will rebound in the third quarter of 2018 with 63% share of revenues. In unit terms, flexible OLED panels will surpass rigid panels in 2021.

By application, the smartphone revenue share is expected to fall from 86% in 2018 to 75% in 2022 due to declining prices and faster OLED growth in other applications. OLED and Quantum Dot (QD) OLED TVs are expected to grow 62% in 2018 and 82% in 2020 to reach 13.1 million in 2022. In smartphones, OLEDs are forecast to overtake LCDs by 2022 as strong growth in flexible panels and the introduction of foldable phone panels overcome the LCD advantage in price.

DSCC has recently released its third quarter Quarterly OLED Shipment and Fab Utilization Report with a five-year forecast of OLED shipments and revenues by application, supplier and size. The report also tracks and compares OLED and LTPS LCD fab utilization and provides analysis of the supply chain for all OLED applications. For more information about the report, please contact Gerry McGinley at 770-503-6318, e-mail [email protected] or contact your regional DSCC office in China, Japan or Korea.

DSCC CEO Ross Young will be presenting the latest outlook for the OLED market at the upcoming OLEDs World Summit 2018 on September 19, 2018 in San Francisco, CA. If you would like to meet with him there, please contact him at [email protected].

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.