DSCC

[email protected]

FOR IMMEDIATE RELEASE: 05/20/2024

Display Equipment Spending to Rebound in 2024

La Jolla, CA -

- Display equipment spending to jump 54% in 2024 after falling 59% in 2023.

- Samsung Display’s A6 fab to lead in spending in 2024 with a 30% share.

- Canon/Tokki to be the top supplier with a 13% share on over 100% growth.

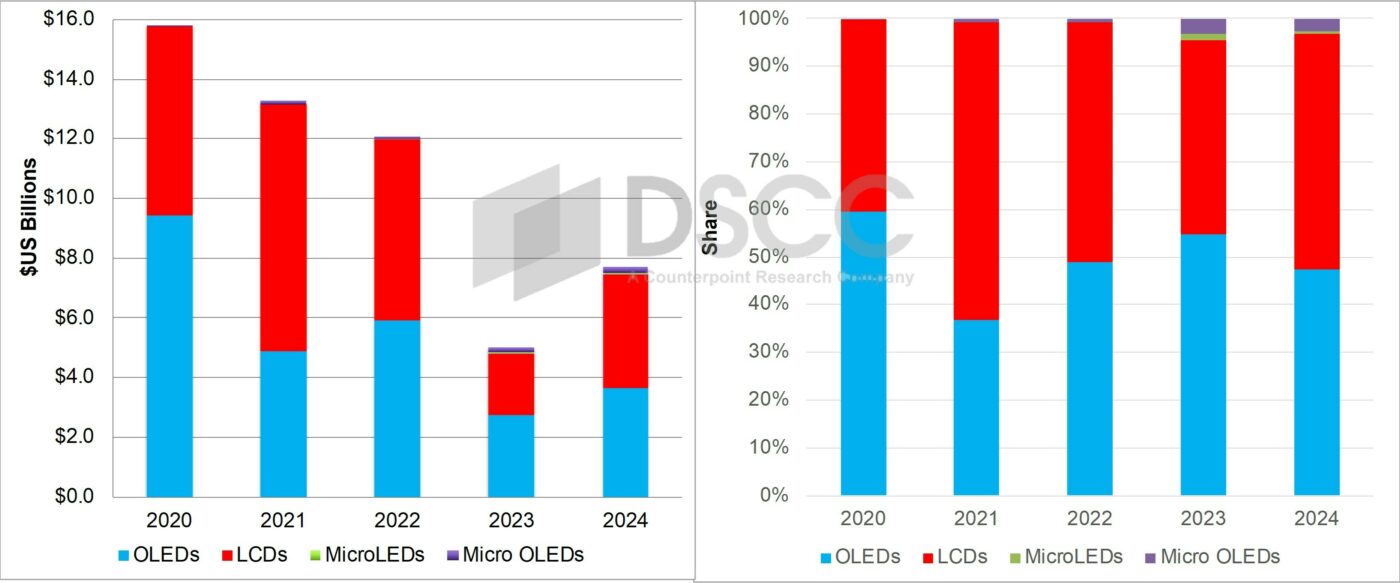

After falling 59% in 2023, display equipment spending is expected to rebound in 2024, growing 54% to $7.7B. LCD spending is expected to outpace OLED equipment spending at $3.8B vs. $3.7B accounting for a 49% to 47% advantage with Micro OLEDs and MicroLEDs accounting for the remainder.

Display Equipment Spending and Share by Display Technology

In 2024, Samsung Display’s G8.7 IT OLED fab, A6, will account for the highest spending with a 30% share followed by Tianma’s TM19 G8.6 LCD fab with a 25% share and China Star’s t9 G8.6 LCD fab with a 12% share and BOE’s G6 LTPS LCD fab B20 with a 9% share. In total, Samsung Display is expected to lead in 2024 display equipment spending with a 31% share followed by Tianma at 28% and BOE at 16%. DSCC’s latest Quarterly Display Capex and Equipment Market Share Report forecasts out fab schedules by display technology through 2028.

Canon/Tokki is expected to lead with a 13.4% share on a delivery basis with their revenues up 100% to over $1B, leading the FMM VTE segment and #2 in exposure. Applied Materials is expected to hold the #2 position with an 8.4% share on 60% growth leading in CVD, TFE CVD, backplane ITO/IGZO sputtering and CF sputtering and 2nd in SEMs. Nikon, TEL and V Technology are expected to round out the top 5. Half of the top 15 are expected to enjoy over 100% growth in display equipment revenues.

IT fabs are expected to account for 78% of 2024 display equipment spending, up from 38%. Mobile is expected to account for the next highest share at 16%, down from 58%.

Oxide is expected to lead in 2024 equipment spending by backplane with a 43% share, up from 2% followed by a-Si, LTPO, LTPS and CMOS.

By region, China is expected to lead with a 67% share, down from 83%, followed by Korea with a 32% share, up from 2%.

DSCC’s Quarterly Display Capex and Equipment Market Share Report forecasts equipment spending by manufacturer, frontplane, backplane, glass size, application, substrate type, equipment type and equipment supplier out to 2027. For more information on this report, please contact [email protected].

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.