DSCC

[email protected]

FOR IMMEDIATE RELEASE: 02/26/2024

China Share of Display Glass Demand Exceeded 70% in 2023

La Jolla, CA -

The display industry has been increasingly dominated by China, and the best example of that dominance is the display glass market. China’s share of display glass demand reached an all-time high and exceeded 70% in 2023, according to the latest update to DSCC’s Display Glass Report, released last week.

The Display Glass Report tracks glass capacity and shipments for all major glass makers across all LCD and OLED display fabs. The report combines DSCC’s comprehensive insight into industry capacity and utilization with an in-depth understanding of display glass and the supply chain. The report outlines capacity by region in each of the four regions of display glass production: Japan, China, Taiwan and Korea, and covers glass shipments in Gen sizes from 1 to 10.5. The report details glass shipments for the three major suppliers to the display industry, Corning, AGC and NEG, along with other glass suppliers. The report includes a supply matrix covering 26 panel makers.

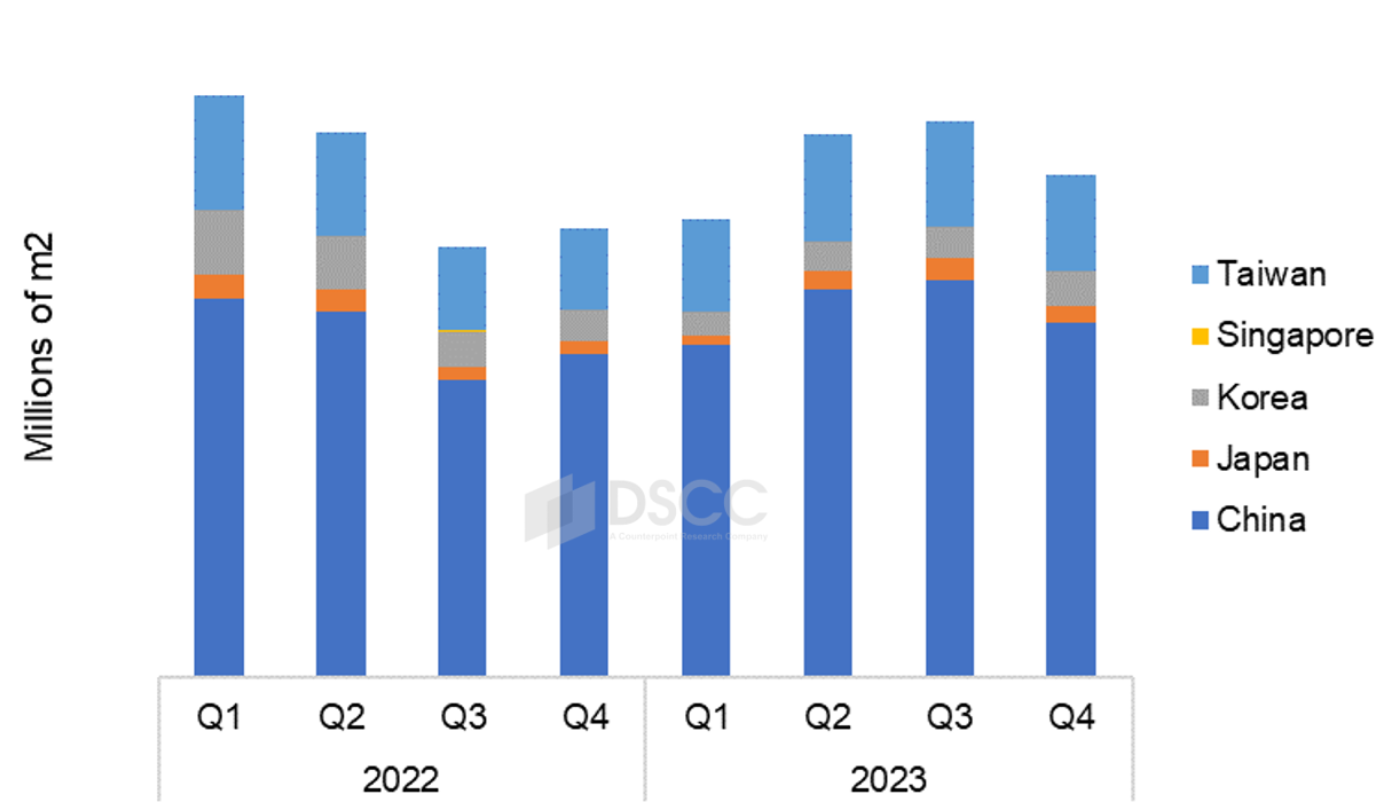

After a 10% Y/Y decline in 2022, display glass shipments stabilized in 2023 and recorded a 2% increase Y/Y in volume terms. Glass shipments declined 10% in Q4’23 as LCD demand softened and are expected to decline another 5% Q/Q in Q1’24 before slowly recovering through the rest of the year.

A view of the market by region demonstrates the increasing dominance of the display industry by China panel makers and the shrinking relevance of Korea in the display glass market. Ten years ago, Korea was the largest region for glass demand, and Korea’s share was 27% at the beginning of 2018 but hit a low point of only 5% of the glass market in Q1’23. China’s portion of worldwide display glass demand, which was only 40% in Q1’18, increased to an estimated 71% in 2023 with growth in new capacity and shutdowns of Korea capacity.

Display Glass Market by Region, 2022-2023

DSCC’s Display Glass Report tracks glass capacity and shipments for all major glass makers across all LCD and OLED display fabs, providing pivot tables that allow splits by region, panel maker, backplane type and TFT Gen Size. The report includes prices for a-Si and LTPS glass for Gen Sizes from 1 to 10.5 and includes quarterly history from Q1’19 and a forecast through Q2’24. Readers interested in subscribing to DSCC’s Display Glass Report should contact [email protected].

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.