Counterpoint

[email protected]

FOR IMMEDIATE RELEASE: 01/06/2025

China AMOLED Evaporation Materials Market Grows 58% YoY in 2024

La Jolla, CA -

- AMOLED evaporation materials revenues are expected to increase 22% YoY in 2024.

- China’s AMOLED evaporation materials market has expanded significantly, growing 58% YoY in 2024 to reach $252 million.

- China’s local players like Jilin OLED, LTOM and Summer Sprout are expected to lead the country’s AMOLED evaporation market.

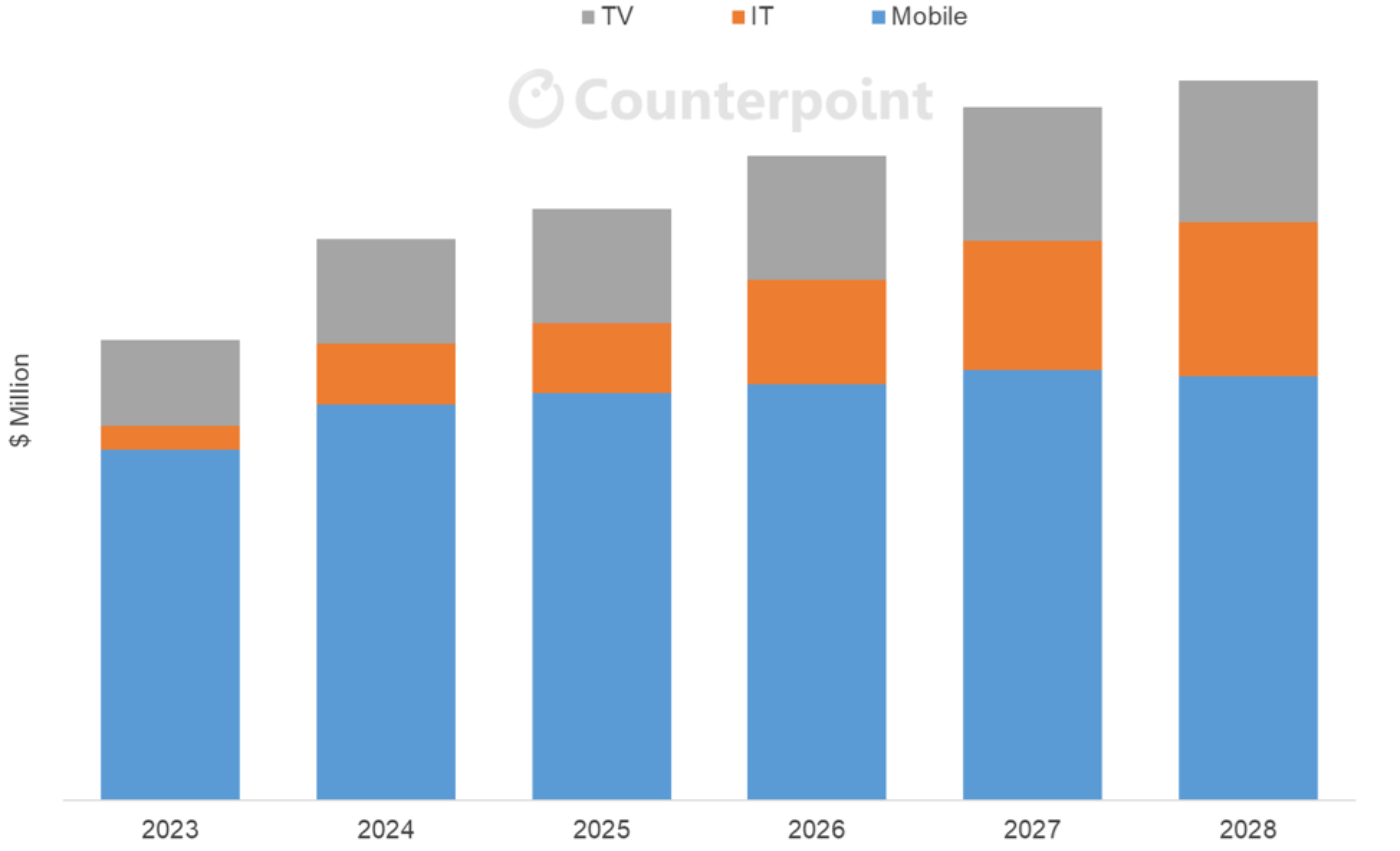

Revenue from AMOLED evaporation materials for all applications is expected to increase 22% YoY in 2024 and grow at a 6.4% CAGR from 2024 to 2028, according to the latest update of Counterpoint's Semi-Annual AMOLED Materials Report. Although the recovery in WOLED utilization rates has been slower than expected, a surge in mobile area increase by Chinese makers and growing IT demand are expected to drive growth in the AMOLED evaporation materials market, aligning closely with H1 2024 forecasts.

AMOLED Material Revenues by Application, 2023-2028

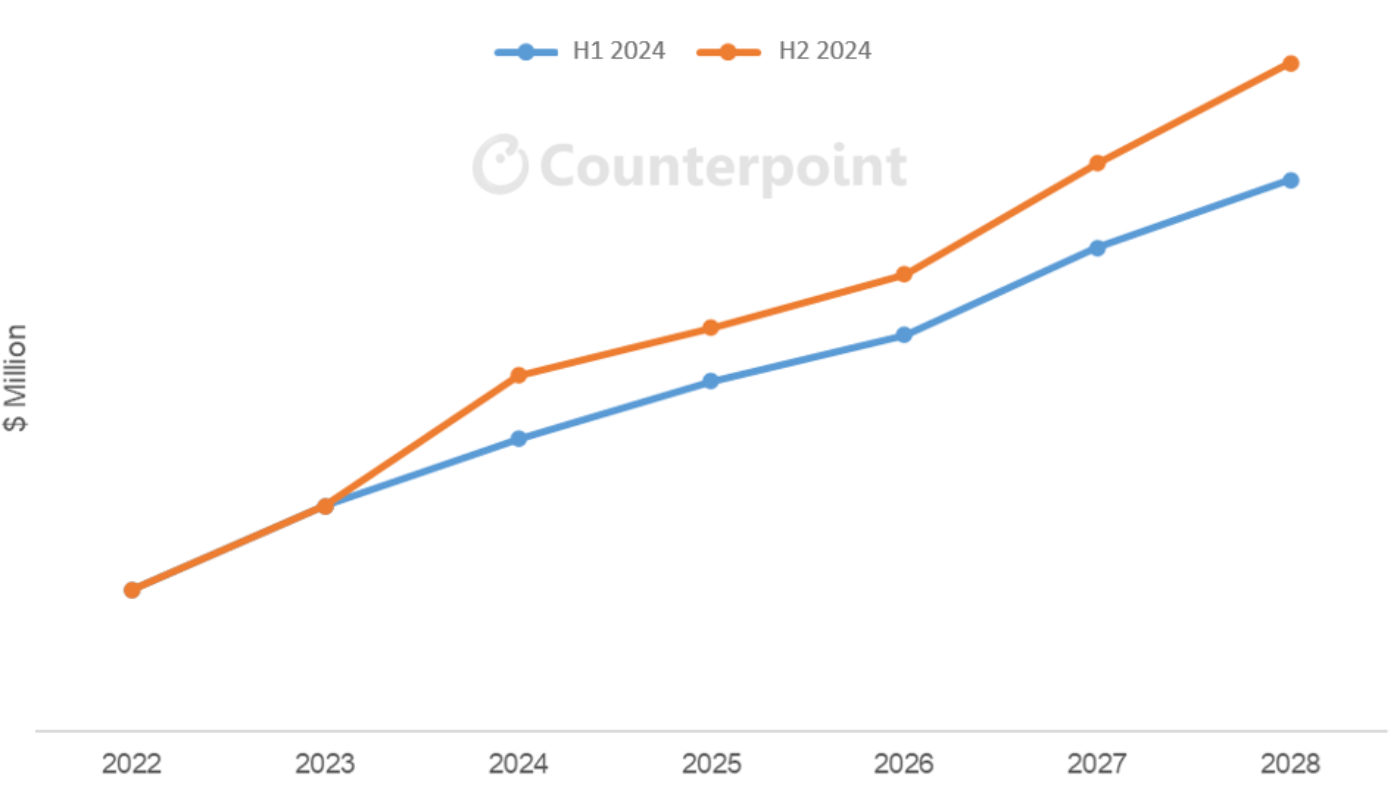

The most notable point in Counterpoint’s AMOLED material revenue forecast is the substantial growth of local suppliers in China. The market size is projected to reach $252 million in 2024, marking a 58% YoY increase from 2023. The primary drivers of this growth are:

- Chinese AMOLED panel makers’ increased utilization rates and input area.

- A higher proportion of materials sourced from local suppliers by Chinese panel makers.

- Expansion of supply by Chinese local material makers, from common layers to R/G/B emitting layers and p-dopant.

The report includes an analysis of AMOLED material structures and suppliers by layer for Chinese panel makers in 2024. This data has been incorporated into the market forecast, enhancing its accuracy. While Jilin OLED and LTOM have traditionally driven the expansion of China’s local AMOLED evaporation materials market, Summer Sprout has recently joined their ranks. BOE, for instance, has started sourcing green dopants and p-dopants from Summer Sprout, which were previously exclusively supplied by UDC and Novaled, respectively. This shift positions Summer Sprout alongside Jilin OLED and LTOM as key players driving the growth of China’s local AMOLED evaporation material market.

Comparison of AMOLED Material Revenue Forecasts for Local Manufacturers in China

Kyle Jang, Senior Analyst at Counterpoint, said, “Previously, Chinese local suppliers have focused on expanding their role in common layers. However, this year has seen a significant increase in the supply of high-value R/G/B emitting materials and p-dopant. Currently, most materials from local suppliers are used within the domestic market. Nevertheless, as the performance gap between local and global material companies continues to narrow, competition between global material suppliers targeting Chinese panel makers is becoming increasingly intense.”

Counterpoint’s latest Semi-Annual AMOLED Materials Report covers:

- Major panel makers’ AMOLED stack architectures and supply chain

- Chinese OLED materials market

- AMOLED market results and forecast by material maker, panel maker, layer and technology

- Status of Next Generation Blue: TADF, Hyperfluorescence, Phosphorescence

- Technology issues and development trends: Tandem, High Efficiency, New Materials, Advanced Technologies

For more information about the report, please e-mail [email protected]

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.