Counterpoint Research, Displays

FOR IMMEDIATE RELEASE: 05/05/2025

Automotive Display Shipments, Revenues, Area Reach New Heights in 2024

Seoul, Beijing, Buenos Aires, Hong Kong, London, New Delhi, San Diego, Taipei, Tokyo -

- While display unit shipments grew slowly along with vehicle shipments, display revenues and display area grew much faster due to vehicle displays becoming bigger and more advanced. In particular, electric vehicles (EVs) and hybrids are driving display growth as they adopt significantly larger displays on average than internal combustion engine (ICE) vehicles.

- Toyota remained the #1 brand on a display revenue basis for at least the third straight year, while Tesla’s Model Y remained the #1 car model on a display revenue basis for the second straight year.

- Counterpoint Research has released its latest shipment report on automotive displays for passenger vehicles on a model-by-model basis, covering the Q1 2022-Q4 2024 period. The report covers the digital information cluster (DIC) and center information displays (CID). Prices are provided for each panel used in passenger vehicles.

Automotive displays are well positioned for future growth as car manufacturers incorporate bigger, better and more displays per car. While the digital information cluster (DIC) and center information displays (CID) grew 2% in 2024 in terms of units based on a vehicle shipment timeline, they grew 5% in terms of display revenue and 12% in terms of display area, according to Counterpoint Research’s latest shipment report on automotive displays for passenger vehicles on a model-by-model, DIC and CID basis. The report covers the Q1 2022-Q4 2024 period.

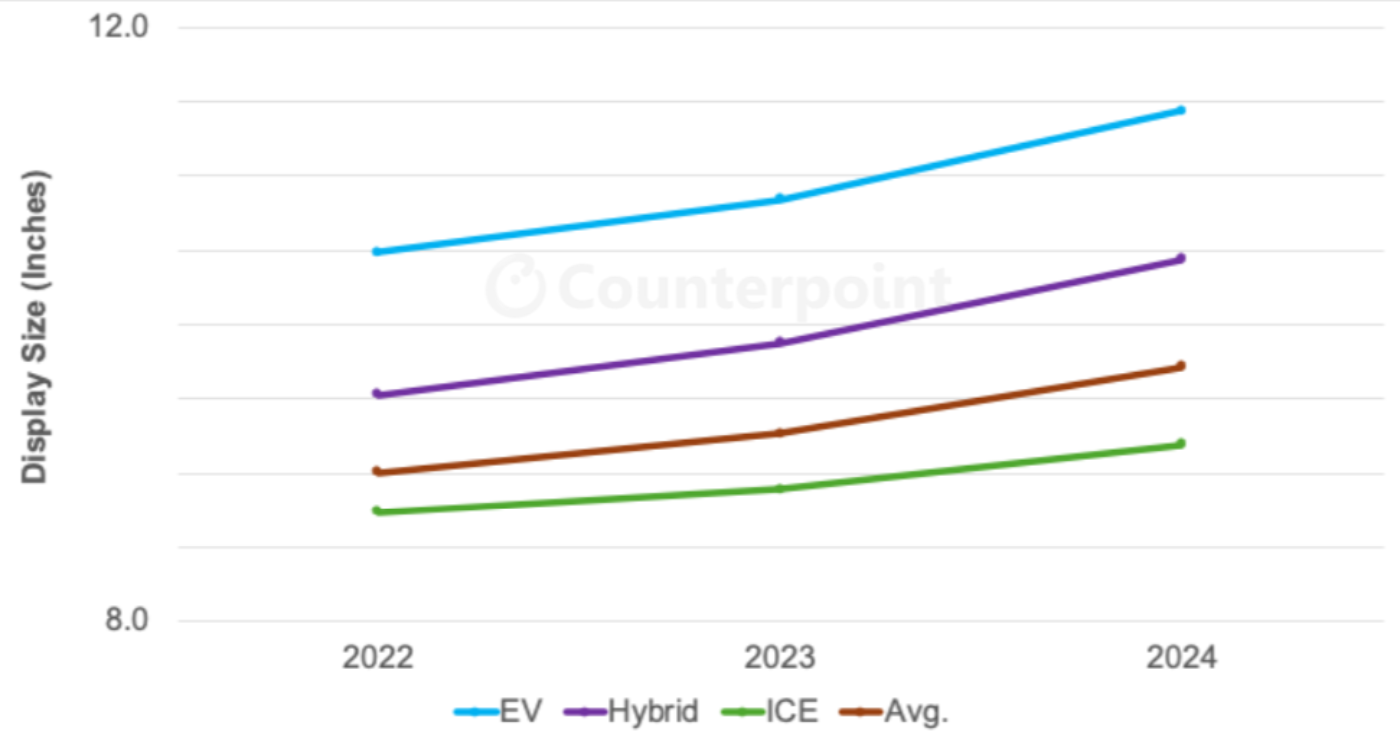

The average display size has grown from 9” to 10” with faster-growing hybrids and electric vehicles (EVs) adopting displays 1”-2” larger than those found in internal combustion engine (ICE) vehicles (see graph below). EV and hybrid displays rose from a combined 23% share on a unit basis in 2022 to 32% in 2024 and from 31% in 2022 to 43% in 2024 on a display revenue basis. Car brands are also adopting large passenger displays with privacy screens to allow passengers to view their favorite content without engaging the driver. Passenger and other types of vehicle displays besides DICs and CIDs will be added to the next version of this report, which should help accelerate automotive display growth.

Automotive Display Shipments by Powertrain by Size

Automotive displays are also getting better. Counterpoint is seeing car brands migrating from lower-performance, legacy a-Si TFT LCDs to better-performing LTPS LCDs, MiniLED LCDs and OLEDs. The a-Si share has fallen from 81% in 2022 to 74% in 2024 while LTPS LCDs have grown from 19% to 26% on a unit basis. LTPS automotive panels overtook a-Si panels on a revenue basis for the first time in Q4 2024 and they tend to be 3”-4” larger.

According to Ross Young, Vice President at Counterpoint Research, LTPS LCDs are gaining share for their higher mobility and smaller transistors, which translate to higher resolution, higher brightness, improved sunlight readability, lower power and lower surface temperatures. LTPS backplane adoption is very high in EVs as another way to extend battery life. Car brands are also adopting OLEDs and MiniLEDs to deliver even better display performance as well as innovative form factors in the case of OLEDs to differentiate from other models and competitors. OLEDs and MiniLEDs accounted for just over 1% of units in 2024 but over 8% of revenues.

Toyota was the top buyer of automotive displays on a revenue basis for at least the third straight year. China’s BYD overtook Volkswagen for the #2 spot in 2023 and rose the fastest among the top 10 brands in both 2023 and 2024. Overall, there were six Chinese brands in the top 20 followed by five from the US, four from Europe, three from Japan and two from South Korea.

Tesla’s Model Y remained the #1 model on a display revenue basis due to its large 15.4” LTPS LCD. It was closely followed by BYD’s Song and Buick’s Envision. Overall, there were eight models from US brands in the top 20 in 2024, followed by five from Chinese brands, three from Japanese brands and two each from South Korea and Europe.

Counterpoint Research is hosting the SID Business Conference on May 13 and 14 at the San Jose Convention Center where there will be plenty of automotive display content from Counterpoint Research, Tianma Microelectronics, Elektrobit, Global Foundries and VueReal. For more information, please visit https://display.counterpointresearch.com/events/2025-sid-business-conference-powered-by-counterpoint-research.

For more information on Counterpoint Research’s automotive display reports, please visit

https://display.counterpointresearch.com/reports/category/automotive

or email us at [email protected].

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.