DSCC

[email protected]

FOR IMMEDIATE RELEASE: 07/15/2024

AMOLED Evaporation Materials Market Expected to Increase 24% Y/Y to $2.12B in 2024

La Jolla, CA -

- AMOLED evaporation materials revenues are expected to increase 24% Y/Y to $2.12B in 2024.

- Market share for Chinese materials manufacturers expected to grow at a 16% CAGR.

- Universal Display Corporation, DuPont, LG Chemical and Samsung SDI are expected to capture 51% of industry revenues in 2024.

According to the latest update of DSCC’s Biannual AMOLED Materials Report, revenue for AMOLED evaporation materials for all applications is expected to increase 24% Y/Y to $2.12B in 2024 and expected to grow at a 6% CAGR from 2024-2028.

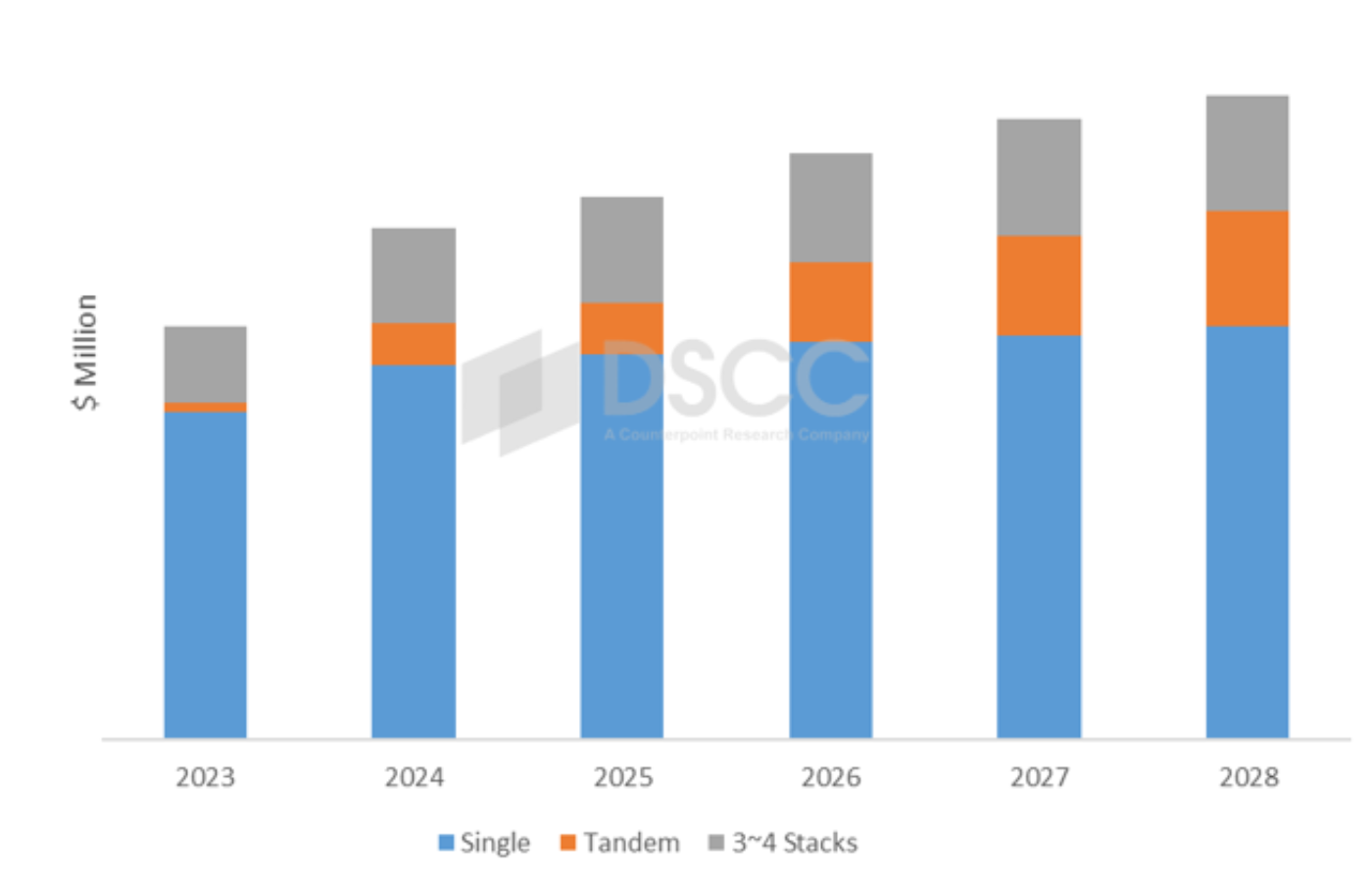

DSCC’s forecast for AMOLED material revenues by stack type is shown in the chart below. "Revenues from the tandem structure are expected to grow at a 30% CAGR (2024 – 2028), while revenues from the single stack and three-four stacks are expected to increase with a 2%-5% CAGR from 2024 to 2028. Following automotive applications, the adoption of tandem structures is expanding into tablet and NBPC products, and it is anticipated that tandem will be the main technology applied in the new G8.7 lines, showing high growth potential," notes Kyle Jang, Senior Analyst of Display Components and Materials.

AMOLED Material Revenues by Application, 2023-2028

DSCC expects the market size for Chinese materials to grow at a CAGR of 16% (2024 – 2028), while the top 10 major materials companies will grow at a 5% CAGR over the same period. Before 2023, most of the localization efforts among Chinese panel manufacturers were focused on common layers, leveraging localization strategies and cost competitiveness. However, starting in 2023, successful localization efforts have extended to key materials such as host and certain dopant materials, with gradual expansion of market share anticipated. As a result, the market direction towards Chinese materials makers is expected to rise significantly.

Phosphorescent blue is the key next-generation material in the OLED evaporation material industry. A key player, UDC, has consistently mentioned its production target for phosphorescent blue starting from 2022, aiming for 2024. However, due to the short lifespan of phosphorescent blue, practical applications incorporating phosphorescent blue are not expected until at least the end of 2025 or later. Reflecting this trend, this report forecasts that the transition from fluorescent to next generation blue (including TADF, Hyperfluorescent and Phosphorescent) will slow down slightly compared to previous expectations. Nevertheless, developing next-generation blue materials to improve lifespan continues to focus on new blue dopants, expected to promote growth in the OLED material industry once implemented.

Universal Display Corporation (UDC) has consistently held the top position in revenue within the industry, a trend expected to continue. DuPont, LG Chemical and Samsung SDI currently occupy the second through fourth positions among materials suppliers. These four companies are projected to capture 51% of industry revenues in 2024 and are anticipated to maintain around 50% of the market share in the coming years. With Chinese material companies experiencing rapid growth, it is expected that some of these companies will rank among the top 10 materials suppliers in the near future.

The DSCC's Biannual AMOLED Materials Report includes profiles for major panel maker’s AMOLED stack architectures and supply chain including single stack/tandem stack/WOLED/QD-OLED, supplier matrices for the main OLED panel makers and revenue projections for 18 different material types and 21 material suppliers. For more information about the report, please e-mail [email protected], or contact your regional DSCC office in China, Japan or Korea.

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.