Counterpoint Research, Displays

[email protected]

FOR IMMEDIATE RELEASE: 04/10/2025

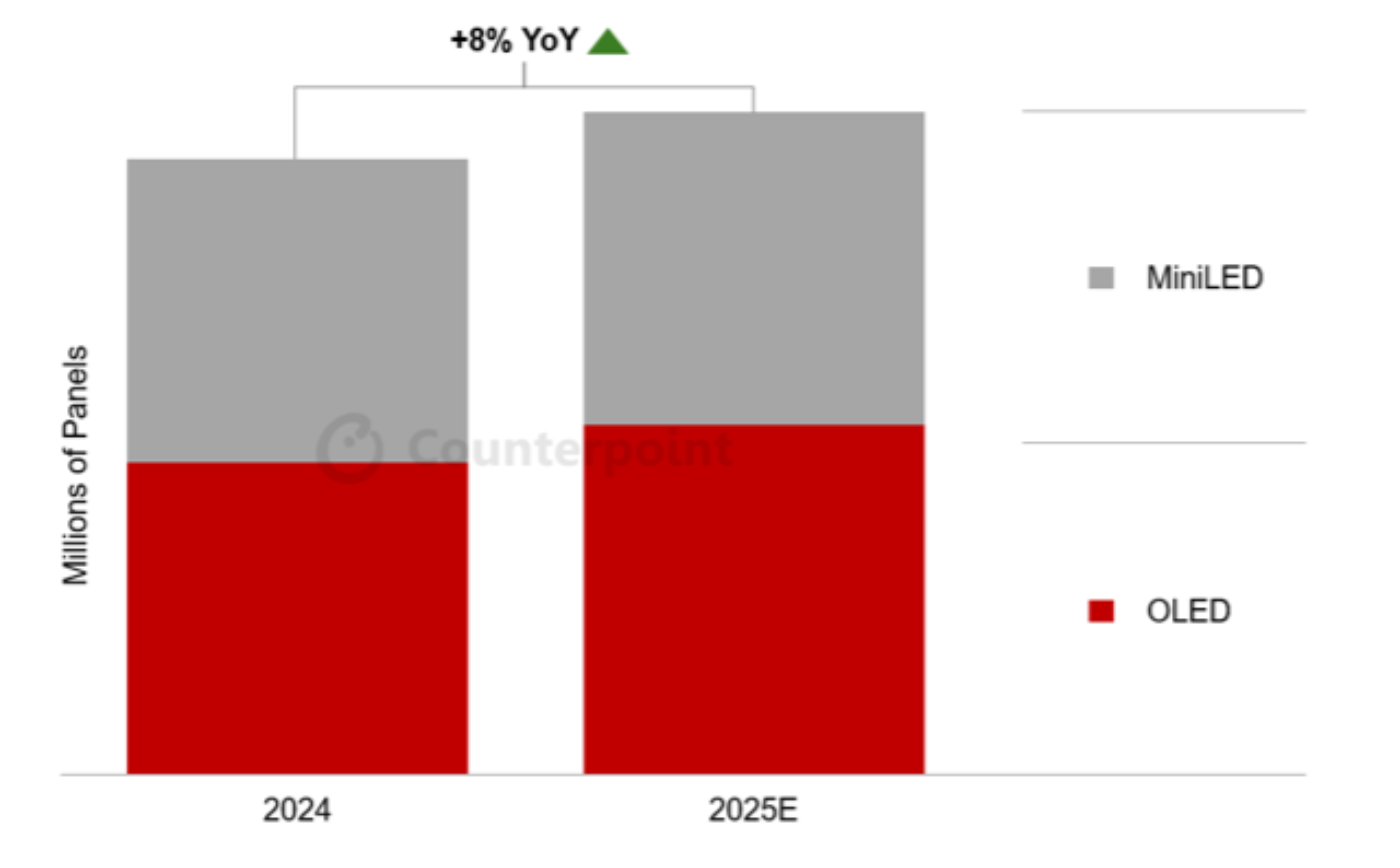

AI PCs, Windows 10 Sunset to Fuel Advanced Notebook PC Display Growth of 8% YoY in 2025

Seoul, Beijing, Buenos Aires, Hong Kong, London, New Delhi, San Diego, Taipei, Tokyo -

- In 2025, we expect the notebook PC category to grow 5% YoY, with advanced notebook PC panel shipments increasing by 8% YoY.

- The biggest drivers for growth are the Windows 10 sunset on October 14, 2025, the rise of AI PCs and the 3-to-5-year replacement cycle.

- In 2024, the notebook PC category recovered and grew by double-digits YoY after declining 13% YoY in 2023.

- OLEDs and MiniLEDs accounted for an 8% share in 2024, up from 6% in 2023, as more brands recognized the potential of Copilot PCs.

Advanced notebook PC panel (OLEDs and MiniLEDs) shipments increased 19% QoQ and 45% YoY in Q4 2024 due to improved conditions during H2 2024, holiday seasonality and the commercial markets’ resurgence, according to Counterpoint’s latest Advanced IT Display Shipment and Technology Report.

For the full year 2024, OLED panel shipments increased 92% YoY and MiniLED panel shipments increased 14% YoY. OLEDs and MiniLEDs accounted for an 8% share in 2024, up from 6% in 2023, as more brands recognized the potential of Copilot PCs. The notebook PC category recovered and grew by double-digits YoY in 2024 after declining 13% YoY in 2023.

In 2025, we expect the notebook PC category to grow 5% YoY after a solid recovery in 2024 and show growth trends witnessed before the pandemic. For the advanced notebook PC display panel category, we expect 8% YoY growth in shipments, with OLEDs having a 53% share, up from 51% in 2024 and 38% in 2023.

Advanced Notebook PC Display Panel Shipments, 2024 – 2025 (E)

Associate Director David Naranjo said, “We remain bullish for the advanced notebook PC category because of the improved consumer and commercial demand fueled by the three-to-five-year replacement cycle, new Microsoft Windows update, inventory stabilization and AI PCs. In 2026, we expect Apple to introduce 14.3” and 16.3” OLED MacBook Pro models, which is expected to fuel double-digit YoY growth.”

*This report was released before the Trump tariff announcements. Readers interested in our latest views, can contact [email protected]

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.