DSCC

[email protected]

FOR IMMEDIATE RELEASE: 07/15/2024

A Strong Q1’24 for OLED Smartphones Fuels Expectations of Double-Digit Unit Growth and 3% Revenue Growth in 2024

La Jolla, CA -

- In Q1’24, OLED smartphones increased 50% Y/Y in units and 3% Y/Y in revenues.

- In 1H’24, OLED smartphones are expected to increase 43% Y/Y in units and 7% Y/Y in revenues.

- In 2024, OLED smartphones are expected to increase 21% Y/Y in units and 3% Y/Y in panel revenues.

As revealed in the Advanced Smartphone Display Shipment and Technology Report, Q1’24 had a 50% Y/Y improvement in units and a 3% Y/Y improvement in revenues versus Q1’23.

“In 2024, we expect double digit unit growth for OLED smartphones as a result of blended panel ASP reductions and the improving, yet cautious macroeconomic environment amid improvements to the first quarter of 2024 versus our estimates. The latest economic indicators are showing that the inflationary environment is stabilizing, and indications point to a strong buildup and momentum for a super cycle fueled by AI and new models from Samsung, Apple and others,” notes David Naranjo, Senior Director.

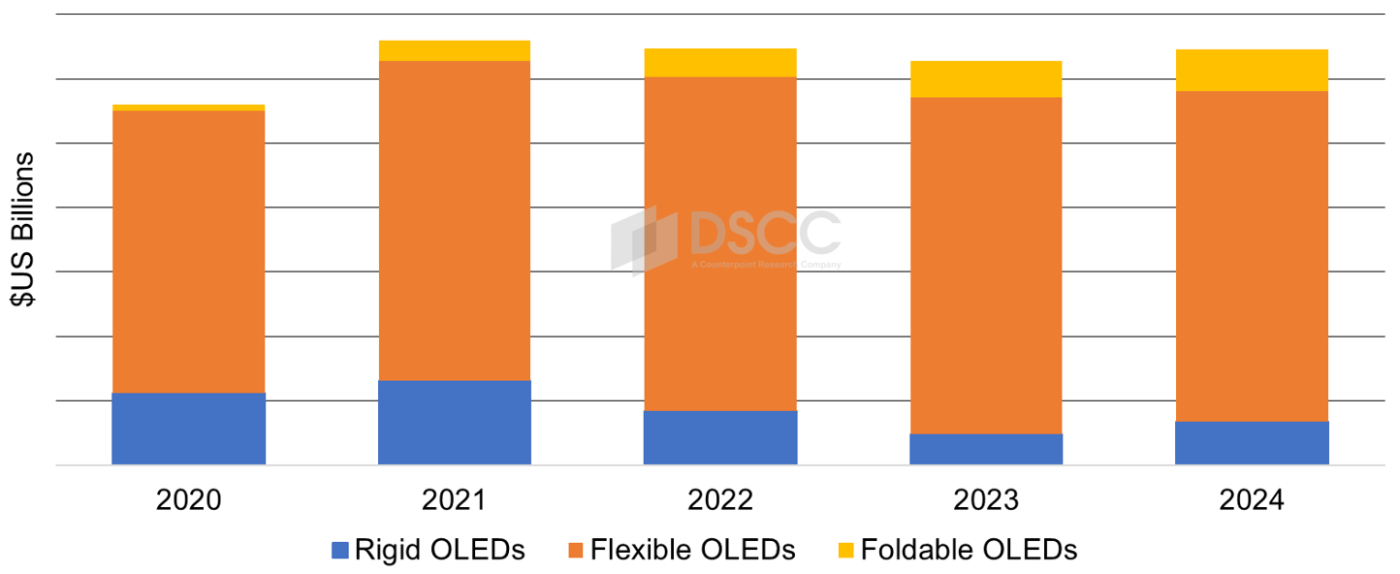

For 2024, we expect OLED smartphones to increase 21% Y/Y in units and 3% Y/Y in revenues with flexible OLEDs increasing 13% Y/Y, foldable OLEDs increasing 26% Y/Y and rigid OLEDs increasing 46% Y/Y.

OLED Smartphone Panel Revenue by Substrate, 2020 -2024

In 2024, by brand, we expect Apple to lead with a 29% unit share and a 50% smartphone device revenue share, down from 36% and 52% in 2023 as a result of gains from Honor, Huawei, Oppo, Samsung Vivo, Xiaomi and others. Samsung is expected to increase its share as a result of a 49% Y/Y unit increase.

The Advanced Smartphone Display Shipment and Technology Report includes updates to market forecasts, costs and smartphone technologies.

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.