DSCC

[email protected]

FOR IMMEDIATE RELEASE: 04/15/2024

A Strong 2H’23 for OLED Smartphones Fuels Expectations of Double-Digit Growth in 2024

La Jolla, CA -

- In 2H’23, OLED smartphones saw a 41% lift vs. 1H’23.

- In 2023, Apple led in units and panel revenues with seven models in the Top 10.

- In 2024, OLED smartphones panel revenues are expected to decline 8% Y/Y.

As revealed in the Advanced Smartphone Display Shipment and Technology Report, the second half of 2023 provided a 41% lift for OLED smartphones and enabled the category to increase 12% Y/Y in units.

“In 2024, we expect reductions to OLED panel ASPs as brands look to lower cost suppliers in order to boost units and revenues for the flagship category,” notes David Naranjo, Sr. Director.

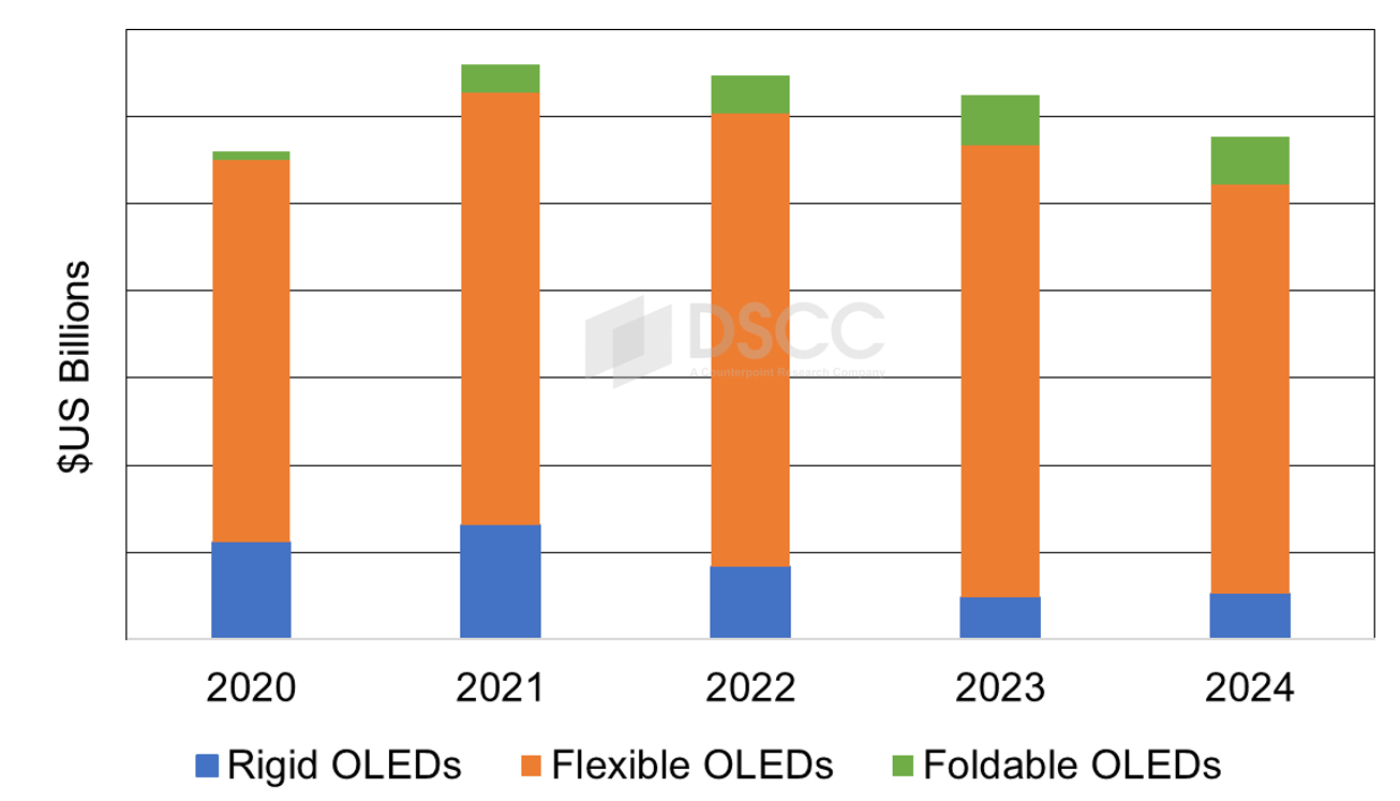

For 2024, we expect OLED smartphones to increase 11% Y/Y with flexible OLEDs increasing 9% Y/Y, foldable OLEDs increasing 9% Y/Y and rigid OLEDs increasing 17% Y/Y.

OLED Smartphone Panel Revenue by Substrate, 2020 -2024

In 2023, by brand, Apple led with a 36% unit share and a 56% panel revenue share, slightly down from 2022 as a result of gains from Honor, Huawei, Vivo and others. Huawei increased share, fueled by the Mate 60 series, Nova 12 series and other models. We also show the latest chipset supplier and specific chipsets. As a result of the Huawei models, HiSilicon also increased share.

In Q1’24, we expect the top five models to be the Samsung A15, Apple iPhone 15, Samsung A35, iPhone 15 Pro Max and the iPhone 14. These five models are expected to account for a 28% unit share.

The Advanced Smartphone Display Shipment and Technology Report includes updates to market forecasts, costs and smartphone technologies.

About Counterpoint

Counterpoint Research is a global market research firm specializing in products across the technology ecosystem. We advise a diverse range of clients – from smartphone OEMs to chipmakers and channel players to Big Tech – through our offices located in the world's major innovation hubs, manufacturing clusters and commercial centers. Our analyst team, led by seasoned experts, engages with stakeholders across the enterprise – from the C-suite to professionals in strategy, analyst relations (AR), market intelligence (MI), business intelligence (BI), product and marketing – to deliver services spanning market data, industry thought leadership and consulting. Our core areas of coverage include AI, Automotive, Consumer Electronics, Displays, eSIM, IoT, Location Platforms, Macroeconomics, Manufacturing, Networks and Infrastructure, Semiconductors, Smartphones and Wearables. Visit our Insights page to explore our publicly available market data, insights and thought leadership, and to understand our focus, meet our analysts and start a conversation.